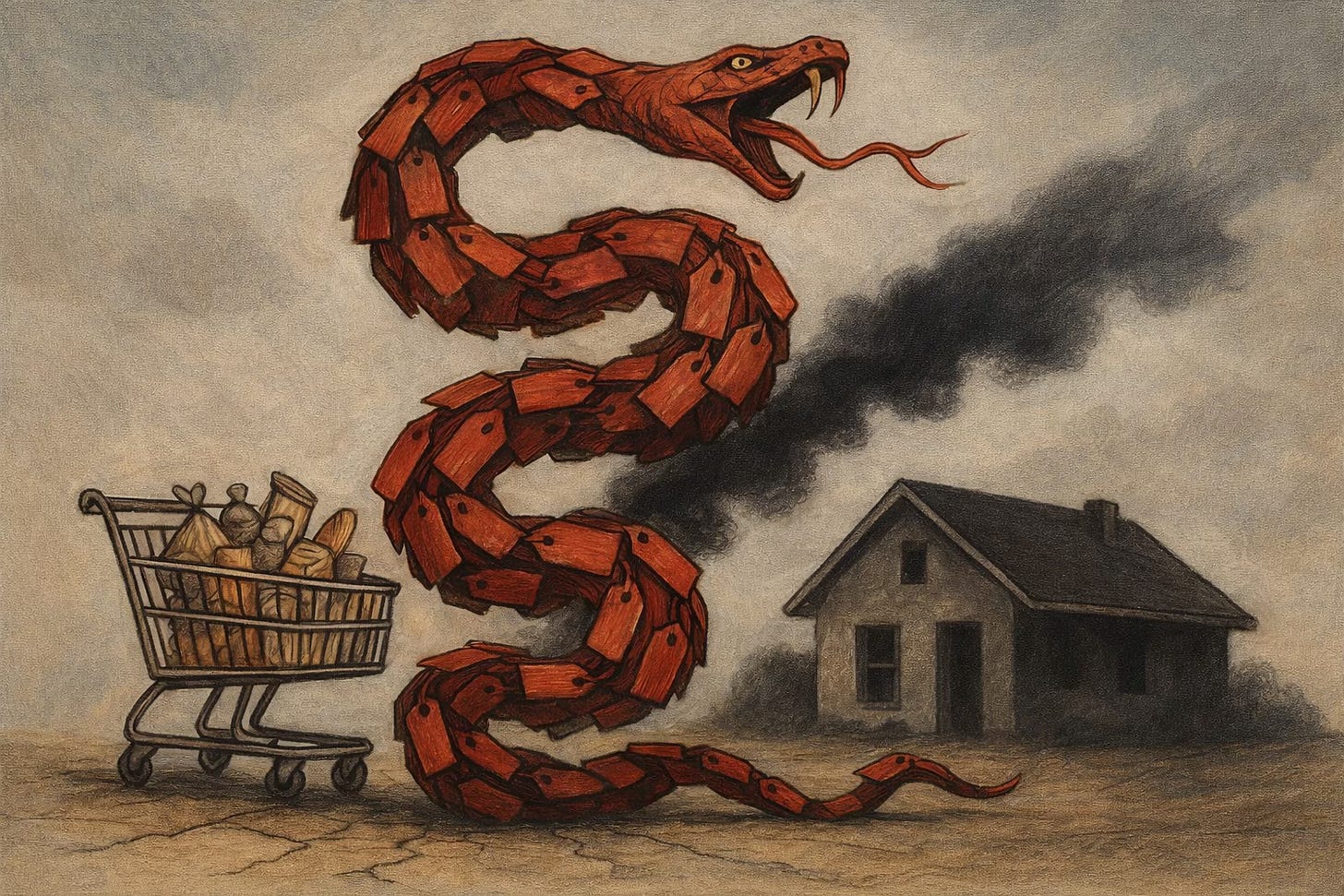

The 2.7% Warning Shot

August tariffs haven't even hit yet.

So here we are. July 15, 2025, and inflation just hit 2.7%, the highest since February.

The numbers themselves aren’t catastrophic. We’re not talking Weimar Republic here. But there’s something almost poetic about watching economic theory play out in real time, especially when you can trace the path from campaign promise to grocery receipt. Housing, food, gasoline all ticking upward.

Back in April, inflation had actually dropped to 2.3%, a four-year low. Then May brought 2.4%. Now June’s 2.7%. It’s like watching a slow-motion car crash where everyone saw the wall coming but nobody hit the brakes. Or maybe they did hit the brakes, plenty of those threatened tariffs got paused or postponed. Which makes you wonder: if this is what happens with the watered-down version, what’s August going to look like?

Come August 1st, we’re looking at 35% on Canadian imports (up from 25%), 30% on everything from Mexico and the EU, and a blanket 15-20% on most other countries.

The Fed, meanwhile, is stuck in this bizarre limbo. They’ve been holding rates at 4.25-4.5% since December, and Jerome Powell is basically playing chicken with the White House. Trump wants rate cuts. Powell wants to see what these tariffs actually do before making a move. Though honestly, at this point, who knows if they’ll cut at all?

The June data already shows tariff fingerprints all over certain categories. Toys up 1.8%. Furniture climbing 1%. Apparel edging up 0.4%. These aren’t massive jumps, but they’re… suggestive.

And yet the markets are weirdly calm about all this. Maybe it’s because Wall Street is betting on another round of delays and negotiations. Or perhaps they figure consumers will just eat the costs like they always do.

Some economists are projecting inflation could hit 3% by December. Not catastrophic, but definitely not the Fed’s cozy 2% target. Seema Shah from Principal Asset Management made an interesting point: without the tariff shock, we probably would’ve hit that 2% target this year.

Penn Wharton’s Budget Model projects these tariffs could reduce GDP by 8% and wages by 7%.

Yet here’s the weird part: this is all happening as planned. Like, this was literally the campaign promise. The execution is matching the rhetoric, which in politics is actually kind of remarkable.

There’s also this cognitive dissonance where July’s numbers might actually look better (the comparison base is easier) and you can already see how that’ll play out. Victory laps if inflation dips, even temporarily. See? Tariffs don’t cause inflation! Meanwhile, August’s effects haven’t even hit yet.

The real test comes when those pre-tariff inventories run dry. Then we’ll see if this economic experiment was worth the price tag.