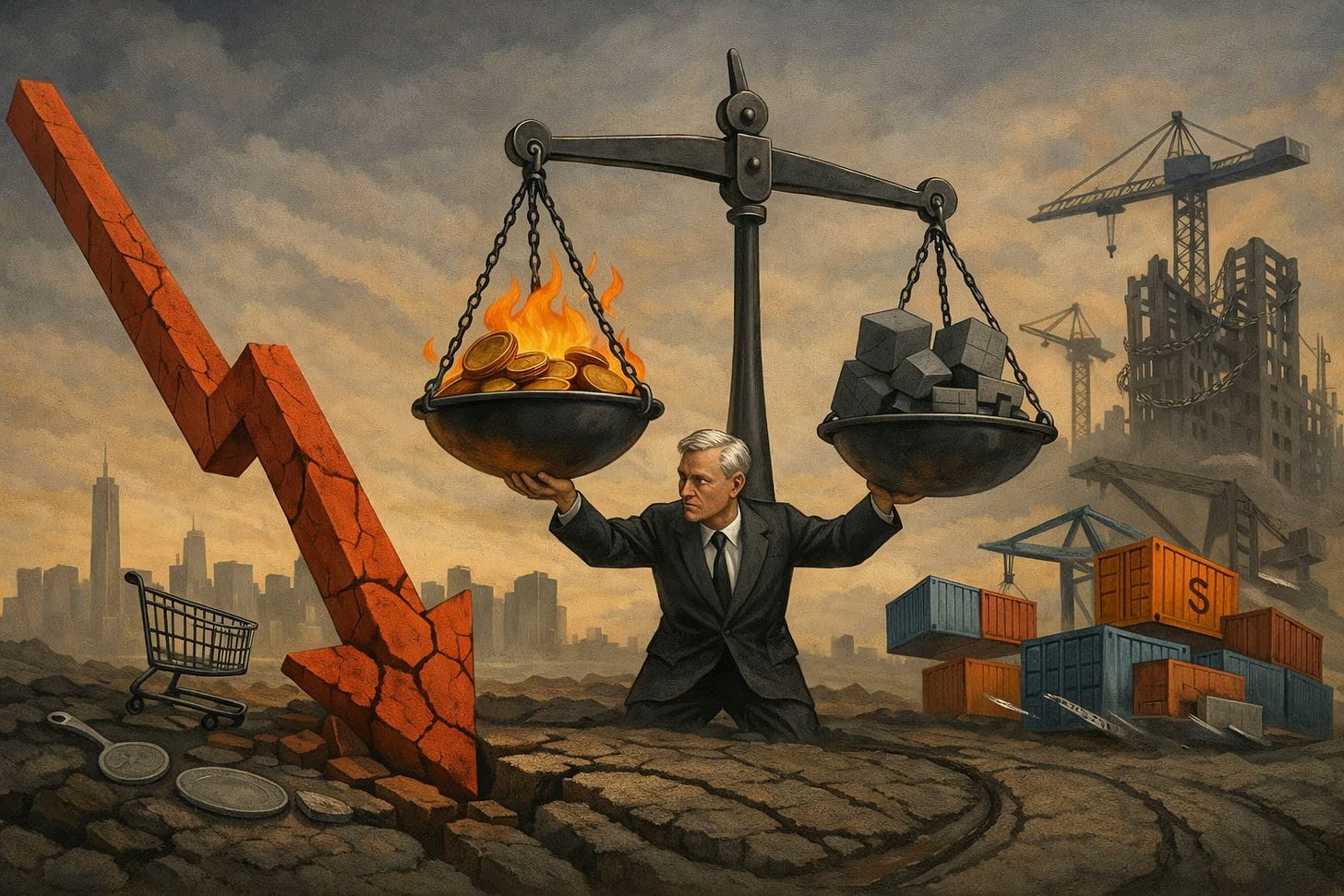

Slower, Stickier, Stuck.

Growth fades, inflation lingers, Fed waits.

The economic data that came out today should’ve drawn more attention. The US economy contracted by 0.5% in Q1 2025, well below the previously estimated 0.2% decline. The revision pointed to real weakness that markets and forecasters underestimated.

Real final sales to private domestic purchasers, one of the cleanest measures of core demand, slowed to 1.9%, down from 2.9% in Q4.

Consumer spending was revised sharply lower. The contribution to GDP fell from 1.21 points to just 0.31. The change reflects a broad pullback in discretionary categories such as recreation, transportation, and dining. It’s an early sign that households are becoming more cautious.

At the same time, the Fed is caught between slower growth and still-elevated inflation risks. Jerome Powell’s wait and see posture is understandable. Cutting rates too soon could reignite inflation. Moving too late risks letting the slowdown deepen. For now, the Fed is choosing patience.

Trade policy hasn’t made this easier. The surge in imports, up 37.9%, was driven by companies rushing to beat new tariffs. That distorted GDP and pushed inflation timing into future quarters. Businesses front-loaded inventory. Inflation from those goods is still coming.

Labor data tells a mixed story. Unemployment held at 4.2%, but continuing claims rose to their highest since late 2021. That suggests a market where hiring has slowed, even if layoffs remain modest. Workers who lose jobs are taking longer to get back in.

Housing shows similar friction. Starts are down, yet home prices remain elevated. Affordability is limiting both sides of the market. CRE stress is also building. With $116 billion in distressed assets and refinancing costs rising, the commercial side is facing pressure. Even data center and logistics space, normally resilient, hasn’t been immune to cost shifts.

Inflation remains a key concern. May’s CPI print of 2.4% looked encouraging, but the details matter. Many companies are still selling inventory acquired before tariffs hit. Surveys show most expect to raise prices in the next few months. Retail giants have already hinted at this. The full inflation effect likely hasn’t landed yet.

This environment has all the ingredients for slower growth with stubborn price pressure. The Philadelphia Fed puts the chance of negative Q2 GDP at 37%, up from 15% earlier this year. Core PCE is expected to stay above 3% into year-end. That’s not crisis territory, but it does limit flexibility.

Politics, predictably, adds noise. Trump’s criticism of Powell isn’t about monetary stance. It’s about managing debt costs. The cost of servicing federal debt now exceeds both defense and healthcare spending. The call for cuts is as much fiscal as economic.

Despite that, Powell has kept the Fed’s posture steady. Rate cuts are possible later this year, but not yet. The central bank wants more clarity on inflation and demand trends before shifting course.

Markets haven’t reacted much to the latest GDP data. Equities remain near highs, supported by liquidity, optimism, and strong performance from a few key sectors. But that disconnect between data and price can’t last forever. If weakness spreads beyond consumer spending, markets will eventually adjust.

The tariff narrative created the appearance of decisive policy. In reality, it’s complicated the path forward. The next few quarters will show whether the recent slowdown is temporary or structural. What’s unclear is the timeline. What’s clear is that the data is no longer background noise.