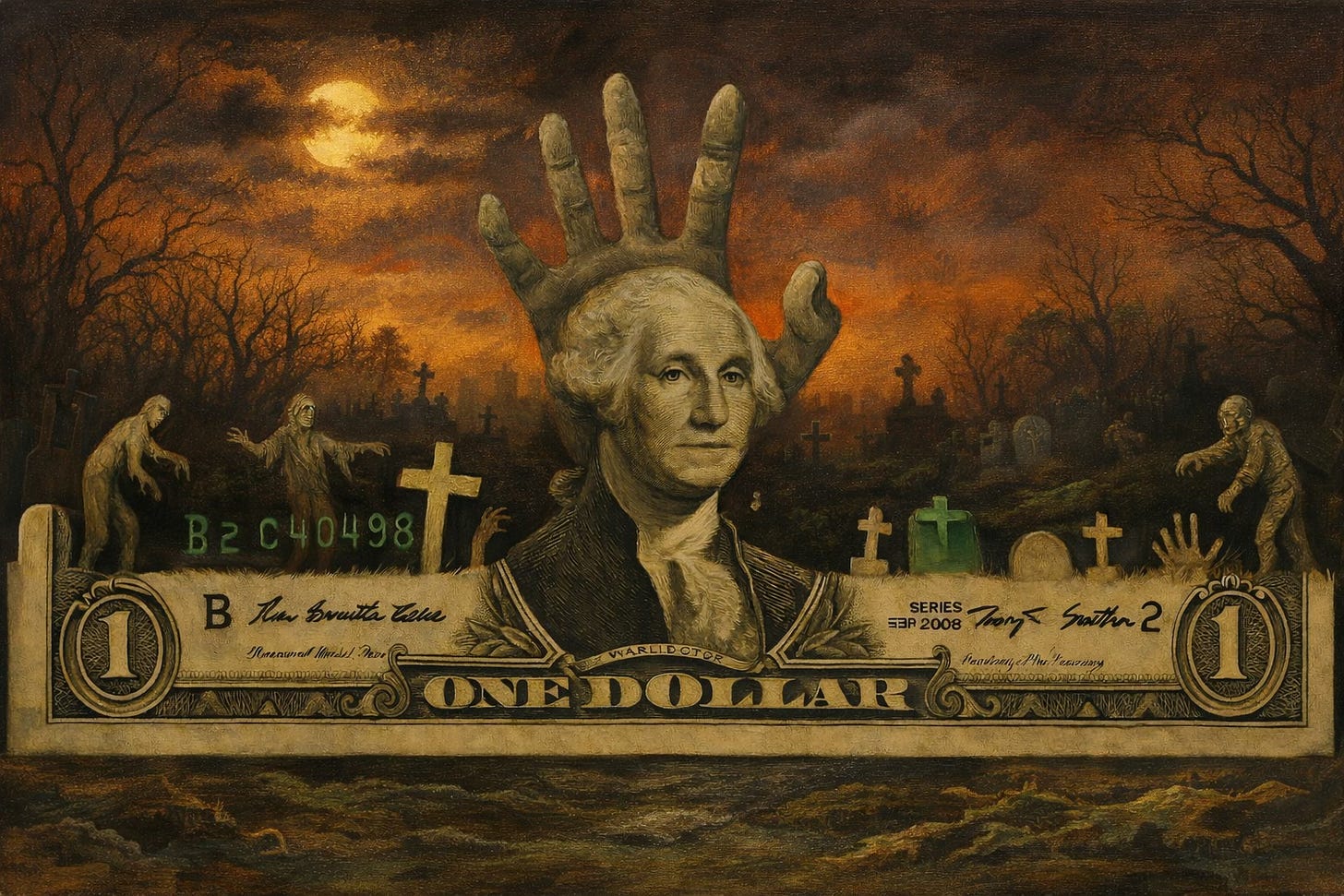

Zombie Banks and Soft Supervision

US community lenders just got permission to run undercapitalized for a year while supervisors look away. Perfect conditions for the next slow motion failure.

The United States is quietly dismantling its financial airbag system while barreling toward a wall at full speed.

A White House obsessed with short-term growth is pressuring the Fed to slash rates, gutting bank supervisors, and rewriting capital rules so Wall Street can gorge on Treasuries nobody else wants. The official story is efficiency and modernization.

The real story? Weaken banking safety margins to finance the trade war and debt binge.

Start with the central bank, because that’s where the political project has gone from noise to capture. Jerome Powell’s term ends May 2026. The Trump team has already floated Kevin Hassett as the replacement, and Hassett isn’t shy about it. His Fed would be friendlier to rate cuts, friendlier to growth, and a lot friendlier to the Oval Office.

Markets aren’t stupid.

When the frontrunner for Fed chair complains the bank has been late to the game cutting rates while inflation hovers around 2.7 percent, traders hear something specific: political cover for looser money. Powell’s Fed is fighting somewhat elevated inflation with cautious cuts. Hassett signals a break from that discipline.

Classic lame-duck trap. The more the White House broadcasts that a future Fed will go full throttle on cuts, the more markets price that future. Financial conditions loosen, asset prices levitate, and Powell’s credibility becomes theater.

Inflation expectations drift not because data changed, but because the political calendar did.

Behind the rate fight sits a deeper insult. Hassett has called the central bank a black box and flirted with a mechanical rules-based regime that would force the Fed to publish an explicit formula for rates. Sounds like predictability. Except the same crowd claiming they want transparent Taylor-Rule frameworks is cheering Hassett because he’ll ignore those rules and cut anyway.

The Fed gets told to reveal its math, then disobey on command.

The politicization doesn’t stop there. The White House has gone after the information environment feeding any independent policy process. A public media bias page with an Offender Hall of Shame. Rebranding MSNBC into MS NOW. Routine labeling of critical coverage as left-wing lunacy.

These aren’t just culture-war toys. They create a climate where any economic statistic conflicting with the official narrative becomes suspect by default.

In that ecosystem, the Fed’s data-dependence becomes political dependence. Monetary policymakers steer by instruments constantly attacked as fake if they suggest any tradeoff between growth and inflation. Independence isn’t revoked in one stroke.

It suffocates in an environment where any rate decision hurting the incumbent gets branded sabotage.

While everyone argues about the future chair, the real attack is happening in bank supervision shadows. Under Vice Chair Michelle Bowman, the Fed is shrinking its Supervision and Regulation division 30 percent by 2026. Staff dropping from 500 to 350.

That’s fundamentally changing how closely the largest banks get watched.

Official line: supervision suffered from mission creep and examiners should focus on material financial risks instead of nagging about processes and paperwork. Sounds efficient.

It’s exactly how Silicon Valley Bank blew up.

When SVB collapsed in 2023, the Fed’s own review traced failure back to governance. Broken risk models, missing chief risk officer, a board that didn’t understand the balance sheet, contingency plans existing mostly on paper. None of that looked material in capital ratios until suddenly fatal.

Bowman’s message: issues like that get de-emphasized until they show up in the numbers. By then it’s too late.

Fewer examiners means fewer site visits, more remote monitoring. But the soft stuff predicting blowups doesn’t show up in spreadsheets first. Management culture, incentive structures, quiet risk concentration.

Tight supervision pushes banks toward safety. Lax supervision leads to risk-taking and crises. The S&L disaster wasn’t just bad rate policy. It was fragmented, underpowered oversight preferring agreements over enforcement.

Elizabeth Warren accused the Fed of taking more cops off the Wall Street beat. When senior supervisors with decades of crisis experience walk out, they take institutional memory that can’t be rebuilt during panic.

Meanwhile, regulators are hacking away at capital buffers supposed to absorb losses when the next shock hits. The new rule on enhanced Supplementary Leverage Ratio for the biggest banks cuts requirements and caps leverage for insured subsidiaries at 4 percent.

The core operating bank runs with far less equity cushion than the old standard.

This gets sold as freeing balance sheet capacity for low-risk activities like Treasury market-making. Regulators argue treating Treasuries same as junk loans in leverage ratios makes no sense and choked dealer willingness when volatility exploded.

On paper it’s a technical tweak. In practice it’s a green light for way more leverage backed by interest-rate-sensitive sovereign debt.

Grant banks room to lever up on Treasuries and they will. Not a rounding error. A chunk of loss-absorbing equity pulled from the system right when credit cycles are aging and valuations stretched.

Small banks get theirs too. Proposed cut to Community Bank Leverage Ratio from 9 to 8 percent, plus doubled grace period for fixing breaches. Community lenders get space to load risk then limp along undercapitalized up to a year before regulators act.

That’s how zombie banks persist, rolling over bad loans and deepening the hole. Eerily reminiscant of S&L forbearancewhen delaying closures padded short-term optics and exploded long-term losses.

None of this happens in a vacuum.

Policymakers are obsessed with balance sheet capacity and Treasury liquidity because the sovereign market already broke once this year. April 2025: Trump tariffs pushed average rates on targeted trade to 27 percent. Markets repriced inflation and growth, yields spiked, dealers on tight leverage pulled back. Bid-ask spreads blew out, order books thinned.

The safest, deepest market looked disturbingly fragile.

November leverage changes for big banks are basically a retrofit solving that embarrassment. If foreign buyers are skittish and leveraged funds won’t warehouse the risk, someone has to absorb government borrowing. That someone is the regulated banking system.

Regulators loosen capital straps so banks can take more, then cross fingers rates don’t jump again turning those safe holdings into massive mark-to-market wounds.

Add operational fragility. Black Friday CME outage briefly froze Treasury futures trading. Looked contained because the calendar was quiet.

A market dominated by a handful of electronic platforms and algo liquidity now depends on uninterrupted functioning of those pipes. When the big venue chokes, price discovery evaporates. Any stress event at the same time risks disorderly cascade.

While this gets rewired, the macro picture moves in the direction making mistakes more likely and painful. Mild stagflation trap. Inflation still above target, moved up from earlier this year. Job gains slowed, unemployment ticking higher. Growth decent but fragile, tariffs threatening another inflation pulse.

Fed already cutting for labor softness while officials admit reasonable possibility inflation stays above target longer than hoped.

Asset prices act like none of this matters until suddenly it will. Equity valuations toward high end of historical ranges, credit markets refilled with leveraged borrowers. Fed’s own Financial Stability Report warns about sharp correction risk tied to AI enthusiasm and speculative narratives.

One bad data run in this environment doesn’t hit a calm system.

It hits a tightly wound one.