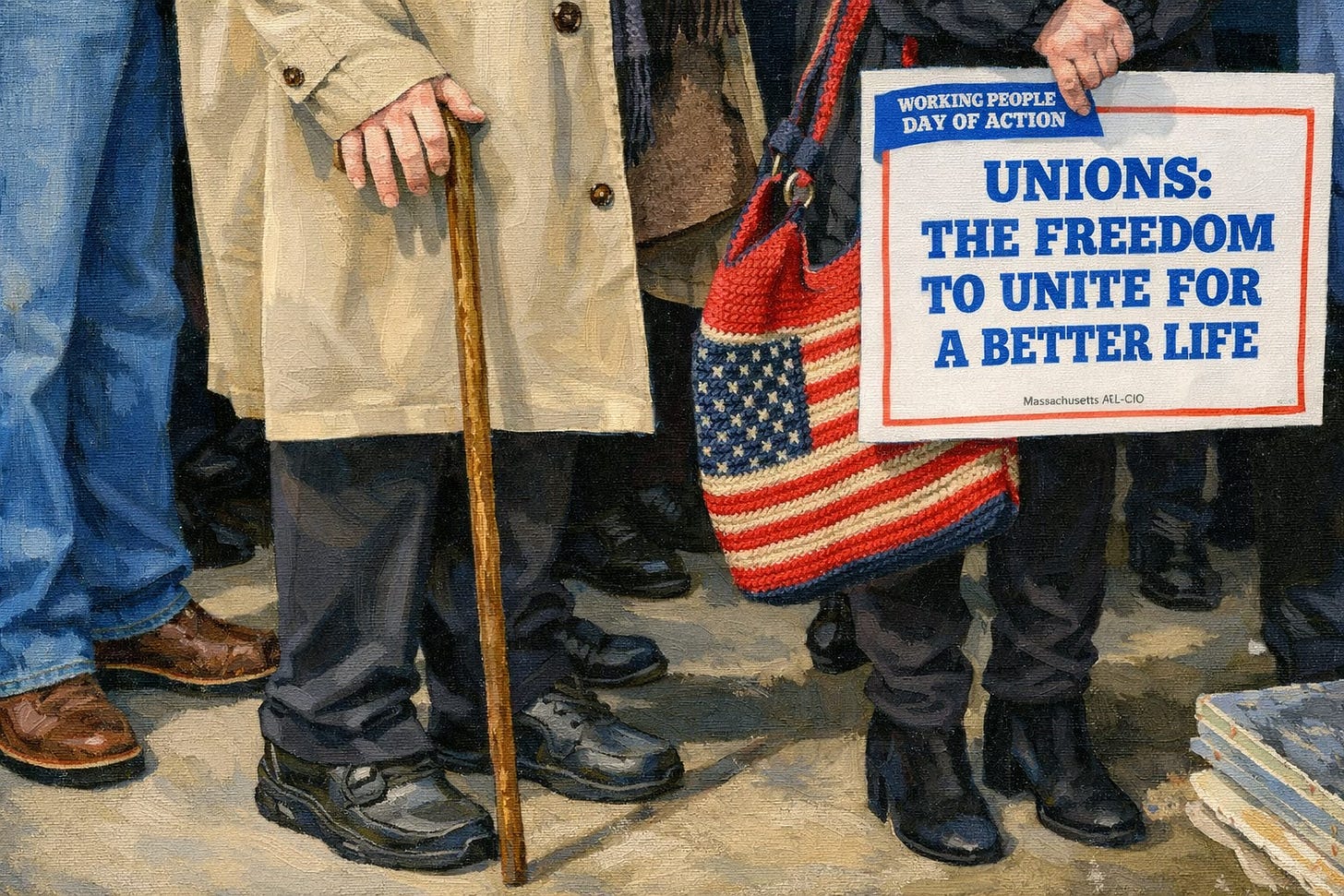

Union Decline, American Politics

Support rises in the polls but contracts and courts still hold the real power.

Three-fifths of Americans think union decline has been bad for the country. Sounds like consensus politics in a fractured nation. See Pew (Aug 27, 2025) for the toplines.

Drill deeper.

Democrats consolidated hard; Republicans fragmented along generation and class. Among Democrats, 85% say union decline hurt working people, up from 74% in 2024. Liberal Dems run hotter (51% very bad) than moderates (28%).

52% of Republicans under 35 say the decline hurt workers vs 27% of those 65+. Income gradient too: lower-income GOP 47%, upper-income 35% call it harmful.

Union density sits at 9.9% in 2024. 14.3m members, 16.0m represented. Half the share of 1983.

Flatline with better PR.

The legal terrain moved June 28, 2024. Loper Bright v. Raimondo killed Chevron deference; gray areas shift from agencies back to Article III. Translation: more stays, longer runways, less presumption for the NLRB when statutes get fuzzy.

Concrete fallout: the NLRB’s broadened joint-employer rule was vacated in Texas (Mar 2024), effectively restoring the narrower 2020 standard and shaving leverage across franchises and logistics.

The Cemex decision from August 2023 still matters—employers who taint elections can be ordered to bargain if unions show card majorities. The Board started using that hammer in 2024. But post-Loper Bright courts will pick those decisions apart, piece by piece.

Management-side firms already mapping the playbook.

Top-line Republicans still say the decline was good for workers (59%), yet the under-35s and lower-income blocks pull the other way. Coalition math gets messy when material risk beats 1980s anti-union talking points. Precarious hours, healthcare cliffs, scheduling chaos at warehouses.

Free-market theory doesn’t fix your rent.

On the ground the outcomes are lumpy.

The UAW blew the doors off at VW Chattanooga: 2,628 yes / 73%, April 19–20, 2024. Four weeks later Mercedes-Alabama voted 56–44 against. Same region, different corporate playbook.

Starbucks is still trench war. Since late 2021: ~650 stores / ~12k workers organized; a framework to bargain announced Feb 27, 2024; sessions resumed in spring; contracts still scarce.

One year into CEO Brian Niccol, FY2024 pay ≈$97.8m. Optics gasoline.

Right-to-work landscape: 26 states (Michigan repeal effective 2024). Policy divergence producing countable results. RTW states lost ≈200,000 union members in 2024, collective-bargaining states +10,000; Michigan +15,000 post-repeal.

Strike activity: 359 work stoppages, ~293,500 workers, 5.3m strike-days in 2024. Enough to nudge wage floors, jam scheduling software, scare competent managers.

The coalition shift gives Democrats permission space for aggressive pro-labor policy. Young Republicans watching paychecks flatten against housing costs don’t care about Cold War union-corruption lore. Working-class GOP voters facing scheduling chaos at Amazon-style warehouses aren’t buying theory when material conditions suck.

That 25-point generational gap inside the Republican party? Coalition stress fracture that widens every election cycle. Watch purple districts in 2026 where moderate Republicans need crossover voters. A pro-worker message that skips the partisan iconography could crack those margins.

The legal recoil slows federal agencies. Real leverage migrates to capital-intensive, time-critical nodes: autos, logistics, healthcare throughput. Places where supply chains don’t wait for court decisions.

Courts slow; supply chains don’t. The smart money watches the cracks, not the consensus.

Source:

Pew Research Center, BLS, Cornell ILR.