The Jobless Boom

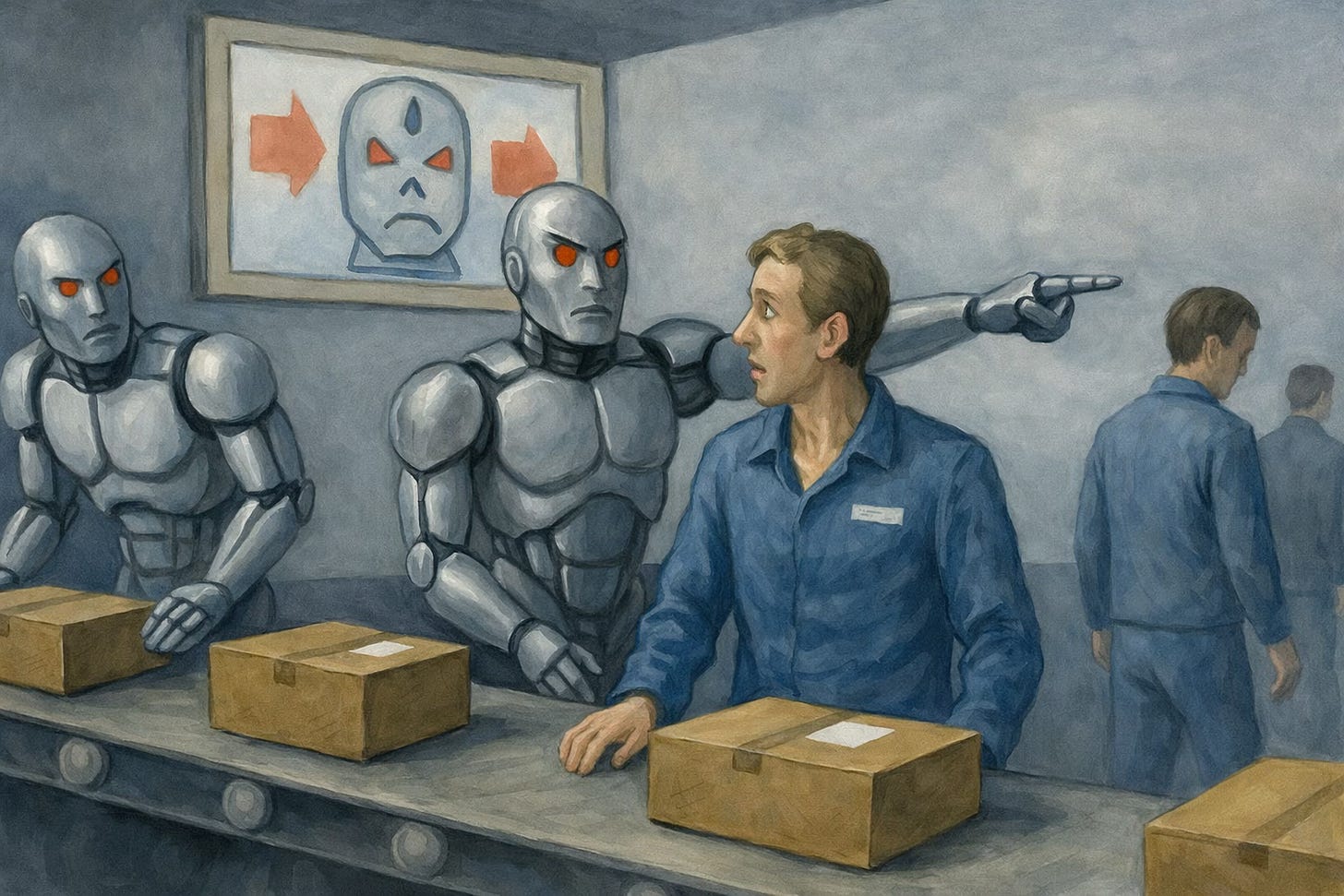

Gen Z faces the first U.S. recovery where growth no longer guarantees jobs.

Growth rolls on, hiring stalls, and the entry ramp is blocked. Goldman’s late-2025 thesis spelled it out plainly: a new regime where productivity does the heavy lifting and payrolls barely twitch. The jobless boom.

A structural rewiring.

Boardrooms got there early. Finance chiefs set the mission to squeeze costs, not expand headcount, then routed capital into automation. Sixty-nine percent prioritized efficiency, with most pointing directly at AI to strip out manual work. Tech leaders followed with full integration claims by the end of 2024, chasing speed and twenty-something-percent productivity bumps.

The result is visible in the data. Hiring turns negative across most industries, with healthcare as the lone exception.

Jerome Powell’s label captures the texture of the stall: low-hire, low-fire. Fewer people getting in, fewer getting pushed out, a market that looks calm because nothing moves. For new graduates, that calm is a wall. The JOLTS lens confirms the freeze, and the share of long-term unemployed tilts younger as entry points disappear.

Goldman also functions as exhibit A. The firm rolled out a GS AI assistant to thousands of employees, compressing the grunt work that once trained juniors. The same shop previously estimated hundreds of millions of roles worldwide sit in AI’s blast radius, with white-collar tracks like finance, admin, and retail most exposed.

Warning issued, model deployed.

This is the investment bank equivalent of an arsonist calling the fire department while still holding the match. But the prediction gains credibility because they’re profiting from it. Productivity surges, margins expand, shareholder returns climb. The labor share of income quietly erodes. The productivity-inequality feedback loop runs smooth and quiet: higher tech productivity means capital captures more of the surplus, which weakens labor’s bargaining power, which allows even more capital accumulation. The returns flow upward by default unless tax systems actively redirect them.

The International Monetary Fund’s analysis is blunt. Taxing capital income needs to become far more progressive to balance this shift, because the gains are accruing almost entirely to those who own the machines, not those displaced by them.

Managers complain about attitude. Surveys say nearly three-quarters label Gen Z difficult. Yet the generation ranks learning and development near the top when picking employers, posts strong engagement when actually on the job, and then bolts if the ladder is fake. Over half report actively looking, and only a thin slice plans to stay put.

Growth-hunting in practice. Move fast, grab skills, upgrade pay, and never assume the company will reciprocate.

Executives praise agility when it means headcount flexibility, then label it lack of commitment when workers do the same thing. Gen Z is simply mirroring the market: fluid, option-seeking, brutally pragmatic about a system that automated their runway before they could taxi.

The high turnover isn’t a character flaw. It’s an efficient market response to systemic uncertainty. When companies won’t provide clear advancement paths (a key driver of turnover across all generations), the only smart move is to arbitrage skill and compensation externally. Loyalty is a luxury when the firm has automated the on-ramp.

There’s also a sober view of the machines. Roughly three-quarters expect AI to reshape their roles, so the hedges look human: communication, leadership, empathy, networks. Others divert to skilled trades in advanced manufacturing (good money without a four-year burn) or toward public service, where interest jumps by forty-plus percent because stability still means something.

Less swagger, more triage.

Healthcare feels like a refuge because it kind of is. Aging demographics keep demand high, direct-care churn forces constant backfilling, and data fragmentation slows the robots. HIPAA walls and scattered records blunt the algorithms, with less than a tenth of surgical datasets even public.

A buffer, yes. A bunker, no.

Once federated learning and clean EHR standards punch through, the administrative and diagnostic middle gets exposed quickly. Use the breathing room or lose the sector. The barriers protecting healthcare jobs are institutional inertia and technical friction (scattered patient data, regulatory complexity, high-stakes environments that resist automation). These aren’t fundamental limits. They’re engineering problems.

When those barriers fall, the sector will face a delayed but devastating automation shock. Administrative roles, diagnostics, logistics: all suddenly exposed.

Policy keeps reaching for the wrong lever. Monetary tools treat symptoms of a demand cycle, not a structural reset in labor demand. Turn the rate dial and the main effect is higher prices without new rungs on the ladder.

Previous jobless recoveries featured adjustment friction: the lag time for firms to reorganize and rehire after efficiency gains. AI represents something different. A permanent reduction in required human labor per unit of output. Not a temporary lag. A fundamental recalibration of the labor-productivity equation.

The velocity matters. AI adoption at nearly half full integration in under two years is faster than any previous technological wave. The displacement happens at a pace that outstrips institutions’ ability to adapt. And the jobs AI targets (white-collar cognitive work, the stuff that required expensive degrees) were supposed to be safe. That bargain is breaking.

The heavy lift is fiscal: modern unemployment insurance with portability, wage insurance for forced downshifts, real funding for sectoral training and apprenticeships, and a tax code that captures the windfall to capital to invest in human capital. The IMF makes that case plainly. Redistribute some of the surplus now, or pay for the fracture later.

Broaden UI coverage. Scale sector-based training. Consider Universal Basic Income not as utopia but as math. The alternative is a permanent underclass of would-have-been knowledge workers subsidizing shareholder productivity.

Corporations optimized for output, not onboarding. AI accelerated the trend. Healthcare buys time, not immunity.

Gen Z isn’t naive, just cornered, and responding rationally to a rigged entry game by treating employment like a marketplace rather than a marriage. The unsettling part is what happens if the ladder stays missing long enough for that mindset to harden.

Time is the enemy. The hiring bottleneck is here now. The fiscal architecture is years away. That lag isn’t a technocratic nuisance. It’s a generational wealth transfer from new workers to entrenched capital owners and older cohorts sitting on the right side of the automation curve. Market outcomes, sure. Also: policy failure with a spreadsheet alibi.

The economy has learned it can grow without creating jobs proportionally. That’s not a recession. That’s a regime change. And the kids graduating into it have figured out the score faster than the institutions pretending everything is fine.

But here’s the thing about rational adaptation: it only works if there’s somewhere to adapt to. If the entire structure of labor demand is shifting away from human input, individual resilience becomes a cruel joke. You can’t skill your way out of obsolescence at scale.

If growth can continue while doors stay shut, social trust does not. The cohort watching the rungs vanish will not forget who pulled them. The machine is winning. And the pretense that it’s a fair fight is wearing thin.