The Bond Market Is Screaming — But No One’s Listening

The era of central bank omnipotence is ending. The bond market has spoken—and the message is brutal.

The orchestra is playing, the champagne should be flowing, but the guests of honor are conspicuously absent. That, in essence, was the scene at yesterday's 20-year US Treasury auction – a soirée so poorly attended, so utterly bereft of enthusiastic buyers, that it sent a chilling tremor through the already fragile corridors of global finance. While the official minstrels hum tunes of "routine reinvestment" and "temporary dislocations," those of us with our ears to the ground hear a different melody: a primal scream from the depths of a bond market utterly fed up with fiscal irresponsibility and the increasingly fantastical narratives spun by central bankers.

One doesn't need a PhD in economics to understand that when you try to sell $16 billion worth of IOUs and can only manage to offload 41% at the "high" (read: unappetizing) yield of 5.047%, something is profoundly rotten in the state of Denmark – or in this case, Washington D.C. This wasn't just a hiccup; it was a "technical disaster," as some of the more candid observers noted, creating a 1.2 basis point tail, the largest since the ghost of December past. This marked only the second 20-year bond auction in history to clear above a 5% yield. The market spoke, and its message was unambiguous: your paper isn't nearly as attractive as you think it is.

And who, pray tell, stepped into the breach to prevent a full-blown public relations catastrophe? Why, none other than the Federal Reserve itself, scooping up a reported $2.19 billion via its SOMA (System Open Market Account) portfolio. "Routine reinvestment," they'll chirp. We've heard that one before. When private demand evaporates, the buyer of last resort materializes, cloaked in excuses. It's the financial equivalent of a Potemkin village, designed to mask the uncomfortable reality that the US Treasury market is increasingly reliant on its own central bank to absorb the relentless issuance of debt. Let's call it what it is: Quantitative Easing, perhaps by a more subtle, "stealth" name, but QE nonetheless. A fake market propped up by, well, you know.

This bond market bedlam didn't occur in a vacuum. It’s the crescendo in an opera of fiscal folly and monetary misdirection that has been building for years. The S&P 500, that ever-sensitive barometer of market jitters, promptly shed nearly 80 points in 30 minutes following the auction's gory details. Coincidence? Only if you still believe in unicorns and congressional discipline.

The bond market didn’t just send a signal—it screamed. And the chaos didn’t end with a botched auction. What followed was a violent repricing of risk, as yields across the curve surged in unison.

The US 30-Year Long Bond, a benchmark for long-term borrowing costs, has been on a tear, breaking through critical technical levels. The so-called “Major Long-Term Resistance” at 4.80% is now a fading memory, and even the “Major Short-Term Resistance” around 5.18% is under serious threat. Today’s bond market action saw the 10-Year Treasury jump 11 basis points to 4.59%, the 30-Year rise 11 basis points to 5.08%, and the 5-Year climb 9 basis points to 4.16%. These aren’t gentle nudges—they’re convulsions.

But this isn’t just about numbers flickering on a Bloomberg terminal. It’s about the real-world cost of money. And that cost is spiking, fast—because the market is choking on debt and bracing for whatever comes next.

The bond market’s nausea isn’t just about today’s debt binge—it’s about the unhinged promises of tomorrow. We’re not just dealing with legacy liabilities; we’re staring into a future drowning in red ink.

The U.S. is now running a budget deficit equal to 7% of GDP. Let that sink in. Seven percent. During a time of (nominal) economic expansion. This isn’t just unsustainable; it’s a flashing red warning light on the dashboard of the global economy.

And it’s not just the raw numbers—it’s the mindset. Ambitious, vaguely costed programs continue to be floated with trillion-dollar price tags and little regard for fiscal balance. History tells us these estimates are almost always wrong—by orders of magnitude. Remember the Iraq war? An initial $3.9 billion projection turned into a $6 trillion sinkhole. That’s the norm, not the exception.

Moody’s recent downgrade of the U.S. credit rating from Aaa to Aa1 wasn’t some dramatic surprise—it was a delayed confession of the obvious. The rationale? Unsustainable fiscal deficits and rising interest costs. Shocking, right?

Congress can play with fantasy math all it wants, but when investors are putting real money on the line, the arithmetic becomes brutally honest. The bond market is demanding higher returns precisely because it believes Congress isn’t serious about fiscal sanity.

This brings us to the Federal Reserve, an institution increasingly resembling a sorcerer whose spells have stopped working. There's a fascinating, and deeply troubling, disconnect occurring: the Fed has nominally been in an easing cycle, yet long-term Treasury yields have defiantly marched higher. One commentator aptly noted that while the Fed might focus on slowing growth and moderating inflation in their rate cut decisions, bond investors are looking at the "bigger picture of massive government deficits, persistent inflation, and the mountain of debt that needs to be refinanced at higher rates."

The stark reality is that fiscal policy has overwhelmed monetary policy. The sheer volume of Treasury issuance required to fund the government's largesse is dictating long-term rates, irrespective of the Fed Funds rate. The Fed can cut short-term rates to its heart's content, but if the 10-year yield keeps climbing because nobody wants the paper without a hefty premium, then financial conditions tighten, not ease. Your mortgage, corporate borrowing costs, and crucially, government debt service, are all tethered to these longer-term yields.

The bond market is telling us, in no uncertain terms, that the Fed has lost its grip on the yield curve. This isn't textbook economics; this is the harsh reality of a sovereign borrower that has abused its credit card for too long.

Which brings us back to the Fed's recent Treasury purchases. A reported $43.6 billion acquired recently, including a significant $8.8 billion in 30-year bonds. "Routine reinvestment," the official line goes. But to a skeptical market, it smells suspiciously like "stealth QE." When demand falters, the Fed steps in. It's a playbook we saw deployed extensively in the past.

The problem is, the Fed is trapped. One viewpoint suggests they have two poisonous pills to choose from:

Reinstitute full-blown Quantitative Easing: Print money to buy their own bonds, artificially suppressing yields. The inevitable consequence? More structural inflation, which then forces the Fed to consider rate hikes, which in turn sends bond yields skyward again. A truly vicious circle.

Do nothing: Let yields skyrocket. The consequence? Banks, already sitting on unrealized losses from their Treasury holdings thanks to the "Biden era inflation" and massive Fed tightening of 2022, begin to implode as those losses become all too real.

It’s a Hobson’s choice of epic proportions. For now, they seem to be opting for a bit of column A, hoping no one calls it by its proper name. But the market isn't stupid.

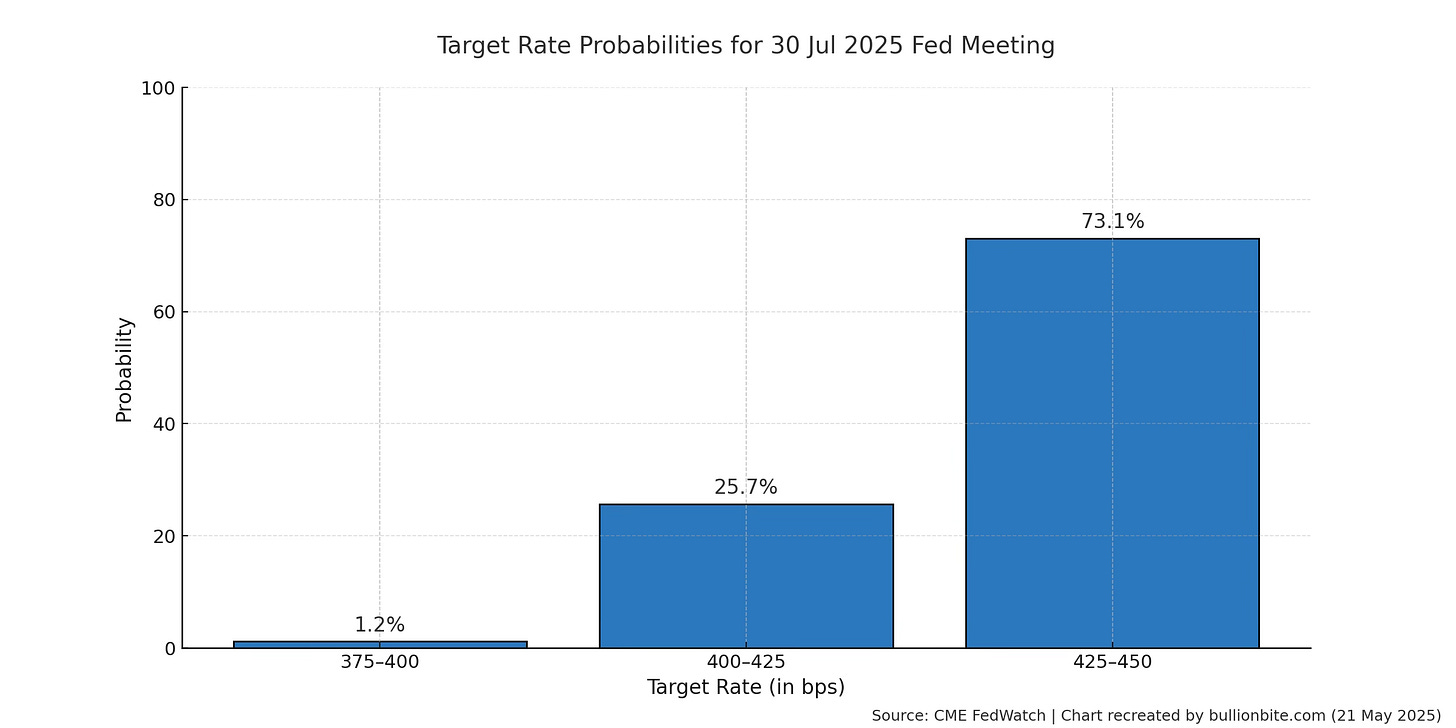

And speaking of the market's intelligence, consider the current expectations for Fed policy. Just a month ago, the median expectation was for two quarter-point cuts from the Federal Reserve. Today? The market is pricing in a 73.1% chance of zero cuts at the upcoming July 30th Fed meeting. The bond markets have now effectively priced out rate cuts for June and July.

This isn’t just a minor adjustment in outlook; it’s a wholesale rejection of the Fed’s prior dovish signaling. The bond vigilantes are back, and they’re not buying the “inflation is transitory” sequel—nor are they convinced the Fed has the will or the capacity to genuinely ease policy while the government issues debt like there’s no tomorrow.

One might even ask, as some wags do: Would anyone be surprised if the next Fed move is a rate hike? No one should be.

Because if rate cuts are leading to higher yields on the long end… what fresh hell does that portend?

When easing tightens conditions, the very definition of monetary policy breaks down.

The unsettling chorus from both fundamental analysis and technical charts seems to be singing a grim tune: stagflation, potentially accompanied by a weakening US dollar. Recent talk of “reciprocal tariffs” only adds fuel to this fire. Tariffs are, at their core, inflationary. They raise the cost of imported goods, disrupt supply chains, and invite retaliatory measures. Combine this with the inflationary pressures of massive government spending (potentially monetized by the Fed) and you have a recipe for persistent price increases.

If this inflation occurs against a backdrop of slowing economic growth—hampered by those same rising borrowing costs and policy uncertainty—then stagflation isn’t just a theoretical risk; it’s a clear and present danger. The fundamentals and the technicals, as MishTalk put it, appear to be pointing in this uncomfortable direction.

Lest we think this is purely a US-centric melodrama, a quick glance across the pond and beyond reveals a disturbingly similar pattern. UK Gilt yields are reportedly at post-Truss panic levels. Japanese yields are rising despite a recessionary environment. German Bund yields are hitting highs even as their economy stagnates. Aussie bonds are breaking out. It's as if developed market bond investors have collectively reached the same chilling conclusion: their governments will inevitably choose to print rather than default. Because, well, math.

This isn't just a series of isolated bond market tantrums. It feels more like a global vote of no confidence in the entire fiat currency system, a system predicated on the increasingly dubious notion that governments can spend without limit and central banks can conjure prosperity out of thin air.

Naturally, the political blame game is in full swing. Some whisper of conspiracies to "set Trump up with the bond market to get a recession," with the Fed refusing to lower rates despite supposed spending cuts. The narrative goes that just as a bill to raise the debt ceiling lands on his desk, he'll be forced to sign it or face a government shutdown and own the ensuing "Trump recession."

While the machinations in Washington are undoubtedly a contributing factor to the uncertainty, it's crucial not to mistake the political theater for the underlying economic earthquake. Congress may indeed be playing poker while showing its hand, and the executive branch ultimately controls the spending levers. But the forces currently roiling the bond market are far larger than any single political actor or party. These are the chickens of decades of fiscal imprudence coming home to roost.

If there’s one pattern markets never fail to ignore until it’s too late, it’s this: big government plans always cost more than promised—and deliver less than expected. As we stare down the barrel of new multi-trillion-dollar proposals, layered atop a mountain of existing debt, the warning signs aren’t subtle. They’re deafening.

“The Big Print,” as Larry Lepard frames it, isn’t coming. It’s already started.

So, if the traditional safe haven of government bonds is looking increasingly treacherous, where does one turn? The more apocalyptic voices in the wilderness are, predictably, pointing toward hard assets. Gold to $25,000 an ounce? Silver to $70? Bitcoin to $500,000 or even $1 million? These are the cries of those who see the endgame of fiat debasement rapidly approaching.

While such forecasts grab headlines, a more grounded view might favor resilience over speculation. In a world of rising borrowing costs and mounting uncertainty, capital is likely to seek shelter in companies with strong balance sheets and real cash flows—while debt-heavy entities get crushed under their own weight.

Sure, some market optimists still talk about pullbacks as “healthy re-entries.” But when the foundation is shaking, how healthy can any level truly be?

Meanwhile, the “sell America” sentiment in the bond market is unmistakable. Investors are demanding a risk premium that reflects fiscal deterioration and policy dysfunction—not just abroad, but right here at home.

The events of the past few days, epitomized by the disastrous 20-year Treasury auction, are more than just a temporary squall. They feel like a fundamental shift, a crack in the carefully constructed façade of the modern monetary system. The bond market, that great arbiter of fiscal prudence, is screaming. It's fed up with fiscal irresponsibility, it's skeptical of central bank omnipotence, and it's beginning to question the very nature of the money it's being asked to hold.

The Fed is trapped. The Treasury is bleeding. The dollar, while perhaps dying slowly for now, faces an existential threat if this trajectory continues. They will print, because the alternative – a deflationary debt default spiral – is politically unpalatable. But printing is not a solution; it's a deferral, an invitation to even greater inflationary pain down the road.

The money illusion is breaking. For decades, the world has operated under the comforting lie that developed market government debt is “risk-free.” That assumption is now being stress-tested in real time—and it’s cracking under pressure. History, it seems, is about to accelerate. Are you prepared?

Because the party where no one showed up wasn’t the finale.

It was just the opening act.