The Banks Look Fine. Until They Don’t.

FDIC Q1 2025: where noninterest income rises but lending doesn’t.

Another FDIC quarterly report, another opportunity to measure what isn’t said.

The Q1 2025 release from the FDIC arrives dressed in rhetorical restraint. Earnings up. ROA up. Deposits up. But the real story isn’t in what improved. It’s in how. And more importantly, in what remains unresolved.

The headlines tout resilience. The footnotes whisper risk.

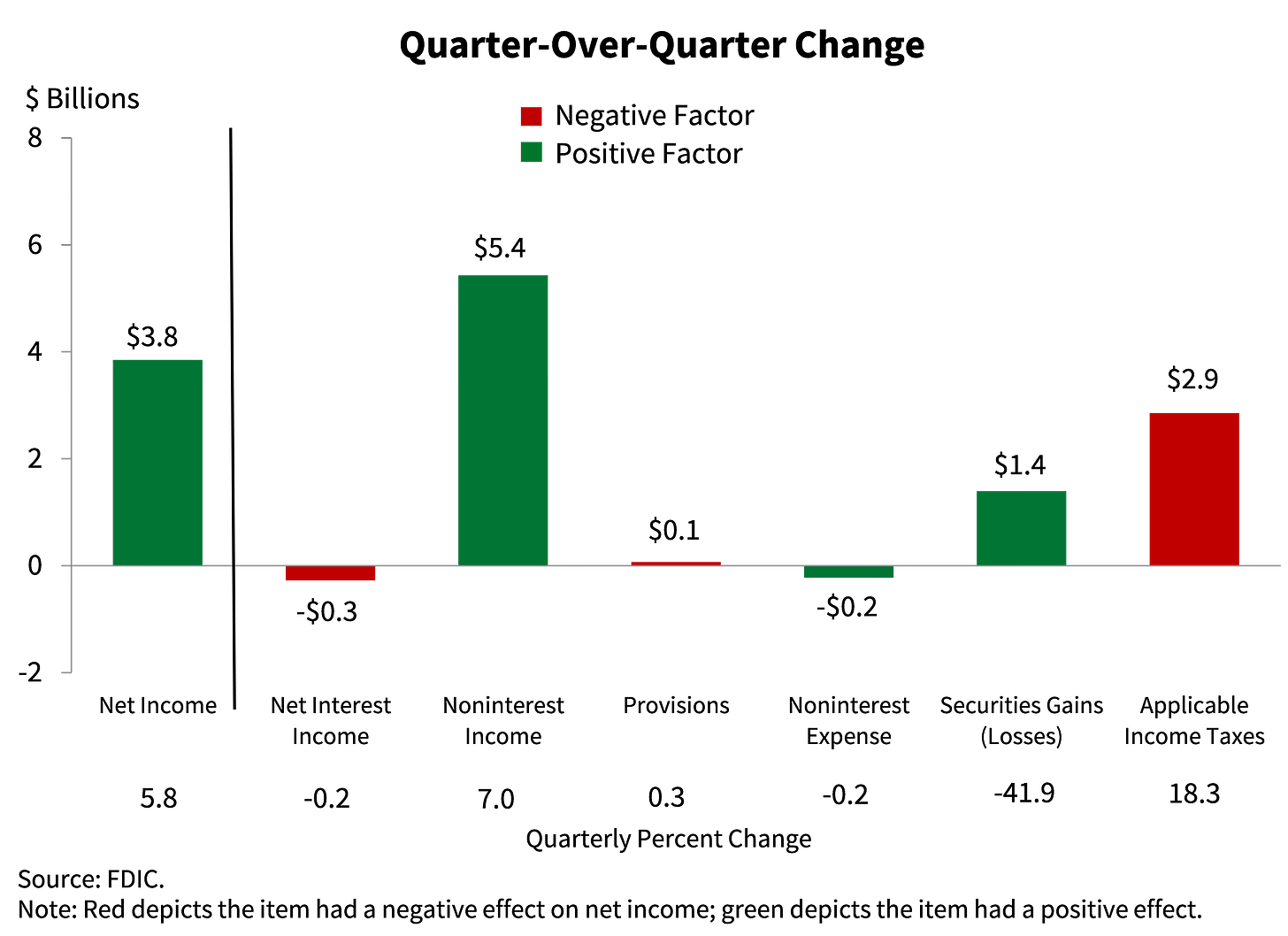

Net income rose to $70.6 billion for the industry, a 5.8% lift. ROA ticked up to 1.16%. But this wasn’t growth powered by lending or core business activity. It was driven by higher noninterest income, largely from mark-to-market gains on securities. In other words, banks, particularly the largest, rode market volatility to pad their earnings. Not a red flag on its own, but certainly not a reflection of economic strength.

Community banks, on the other hand, saw a 10% bump in net income the old-fashioned way: through higher net interest income and disciplined cost management. No sleight of hand. No derivative-driven boosts. Just traditional banking. The difference is subtle, but critical.

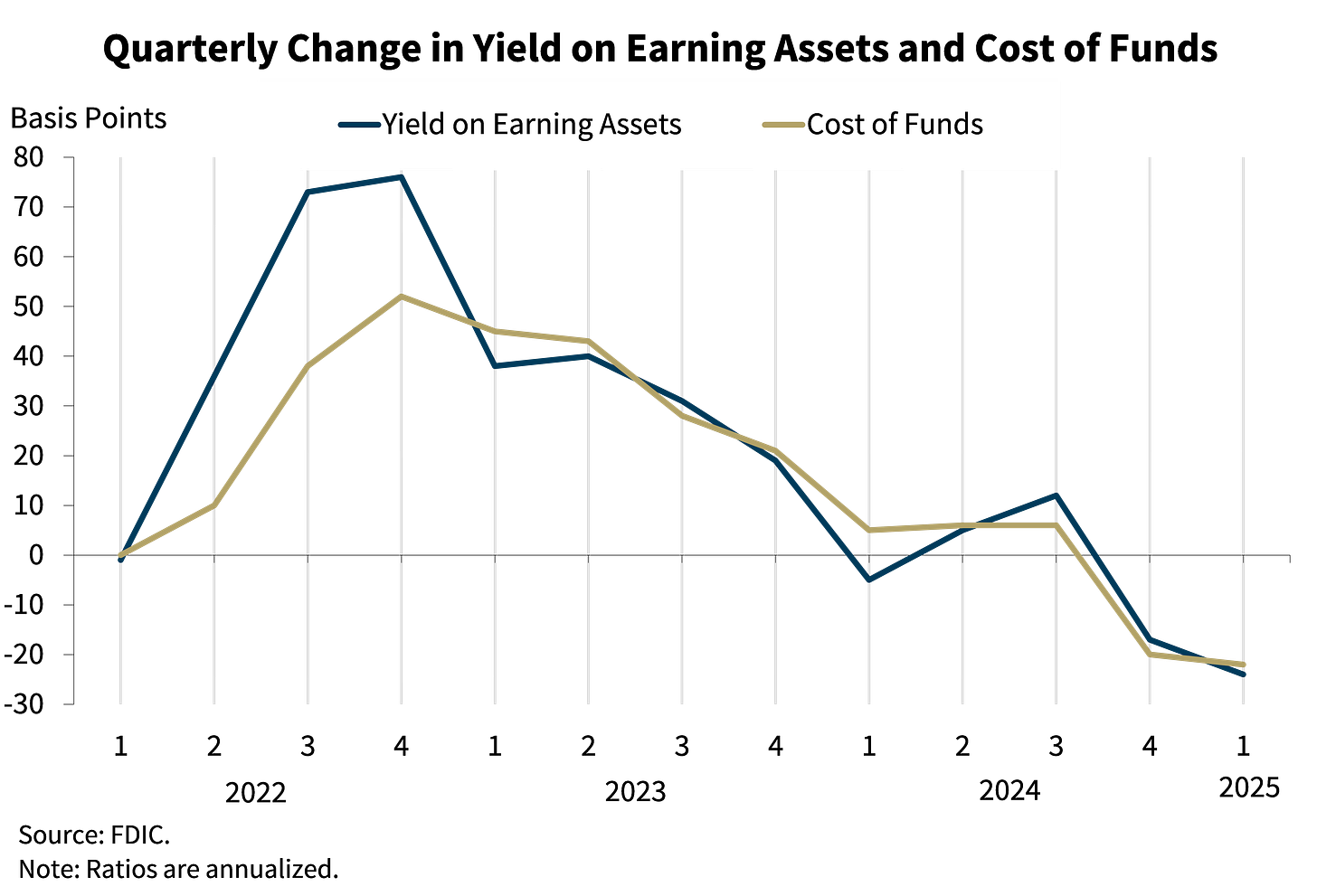

Across the board, however, net interest margins declined. For the broader industry, NIM slipped two basis points to 3.25%. The FDIC says that’s in line with pre-pandemic levels. But with yields on earning assets dropping faster than funding costs, that margin compression reveals a creeping squeeze.

Community banks once again showed a different trajectory. NIM rose to 3.46%. Their cost of funds declined more rapidly than their asset yields. That suggests relationship-based deposits are helping them navigate this environment better than their larger peers.

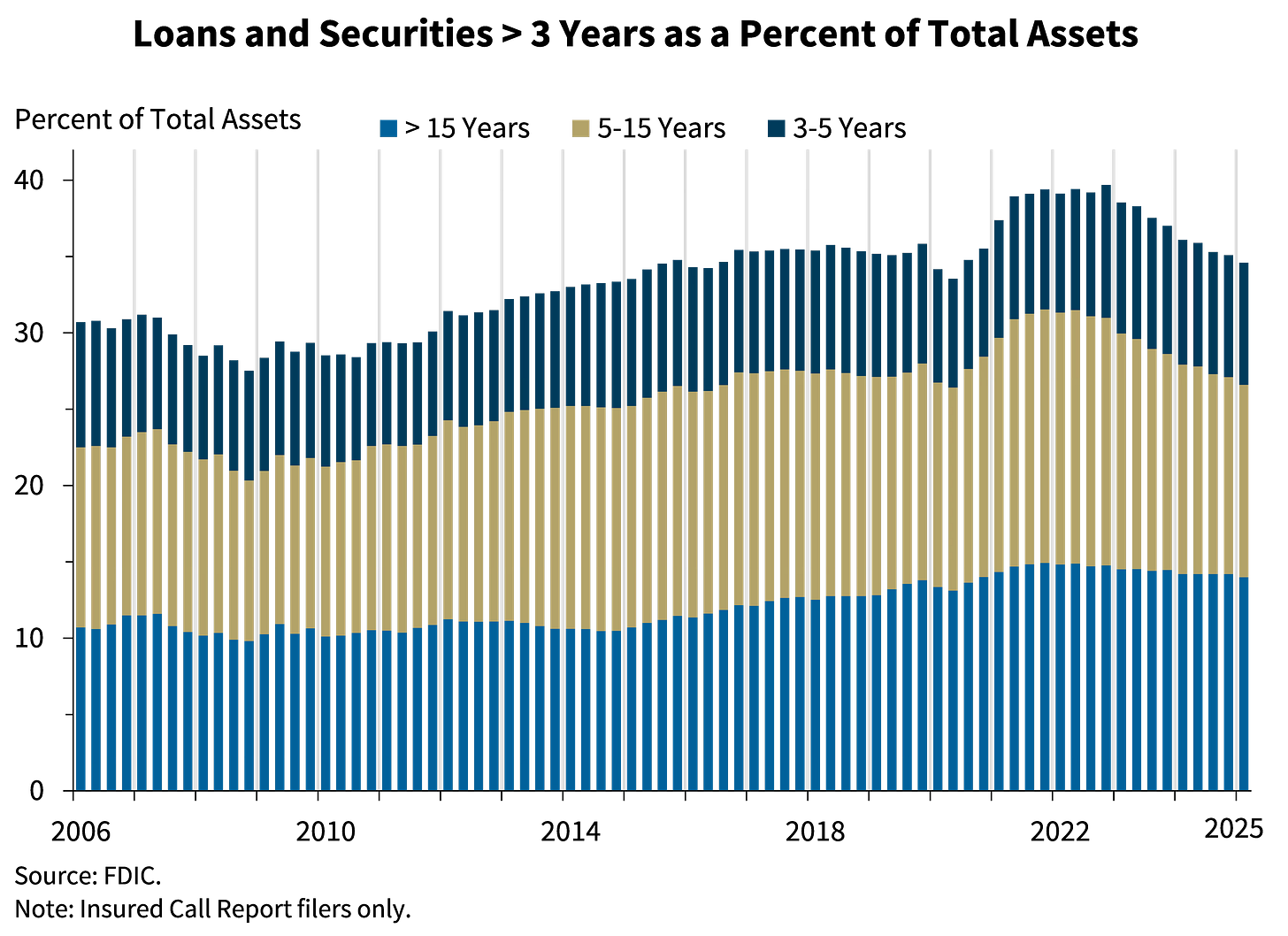

Unrealized losses on securities improved on paper, falling by $67.5 billion to $413.2 billion. A temporary reprieve, thanks to falling long-term rates. But even the FDIC admits this is ephemeral. Rates have since risen. If the numbers were marked today, most of those gains would vanish. This isn’t risk reduction. It’s a snapshot, taken at the right angle.

All it takes is one bad news story about any of these banks, and we could have another banking crisis.

Rebel Cole, former Fed official

The notion that these are just harmless paper losses is comforting and dangerously misleading. Collateral value matters. If bonds held to maturity lose value, it may not hit the income statement, but it hits the balance sheet. And when depositors sniff weakness, they run.

The de-risking trend continues. Assets with maturities over three years now account for just 34.6% of total assets. Prudent, but it also means less long-term lending and less revenue growth potential.

On the surface, asset quality appears stable. PDNA rates dropped to 1.59%. But commercial real estate, particularly non-owner occupied CRE at the largest banks, tells a different story. PDNA rates in that category hit 4.65%, up from a pre-pandemic average of just 0.59%. That is not a soft spot. That is a structural fault line.

Mid-sized banks, holding heavier concentrations of these riskier CRE assets, are even more exposed. Office properties, already pummeled by remote work and higher financing costs, are dragging loan books into dangerous territory.

Credit card charge-offs remain elevated. At 123 basis points above pre-pandemic norms, they signal that household stress is worsening. Rising costs, shrinking savings, and higher debt burdens are translating into real losses.

Even as stress builds across asset classes, the FDIC’s deposit insurance fund continues to grow, a necessary buffer in a landscape where systemic risks remain deeply embedded. The reserve ratio has risen, and the total balance stands at $140.9 billion. That’s encouraging, but it is not a sign of safety. It’s a recognition of the risks ahead.

So here is the takeaway. Not collapse. Not crisis. But not comfort either. The system is adapting, not thriving. Stress is being managed, not eliminated. Resilience, as portrayed in this report, is more a reflection of how well the system is papering over vulnerabilities than resolving them.

The banking system is not flashing red. But the yellow lights are multiplying. And in this environment, ignoring the dashboard comes at your own risk.

References: