The 4.2% Lie

One in four Americans is functionally unemployed. No one in power wants to talk about it.

4.2% unemployment.

That’s the number plastered across headlines, Fed statements, and cable news tickers. To the casual observer—or the policymaker seeking political cover—it sounds like America is nearing full employment. The labor market, we’re told, is strong. Solid. Resilient.

Except it’s not. At least not for one in every four working-age Americans.

According to the Ludwig Institute for Shared Economic Prosperity (LISEP), the real unemployment rate isn’t 4.2%. It’s 24.3%.

That’s not a typo. Nearly one in four Americans is “functionally unemployed”—a term that doesn’t show up in White House briefings or central bank transcripts but might be the most important labor market metric you’ve never heard of.

Let’s cut through the fog. The official Bureau of Labor Statistics (BLS) unemployment rate—called the U-3—counts you as “employed” if you worked just one hour in the past two weeks. Yes, one hour.

You could be living in a tent, working for Uber Eats once a week, and still be considered “fully employed” in the eyes of Washington, that counts as economic strength.

LISEP, founded by former Comptroller of the Currency Gene Ludwig, doesn’t buy that. Their True Rate of Unemployment (TRU) adds two crucial categories to the standard definition: people who want full-time work but can only get part-time jobs, and people earning below $25,000 annually.

This broader measure reveals a grim truth. Millions of Americans are technically employed but still economically insecure—trapped in low-wage jobs, gig work, or fractional employment that fails to cover basic expenses.

Working poverty isn’t employment success. It’s a policy failure.

Here's the comparison:

In 2023, the average household needed $67,000 annually to afford a minimal quality of life. Many families earned just $38,000. That’s a $29,000 shortfall, even for households where someone is working.

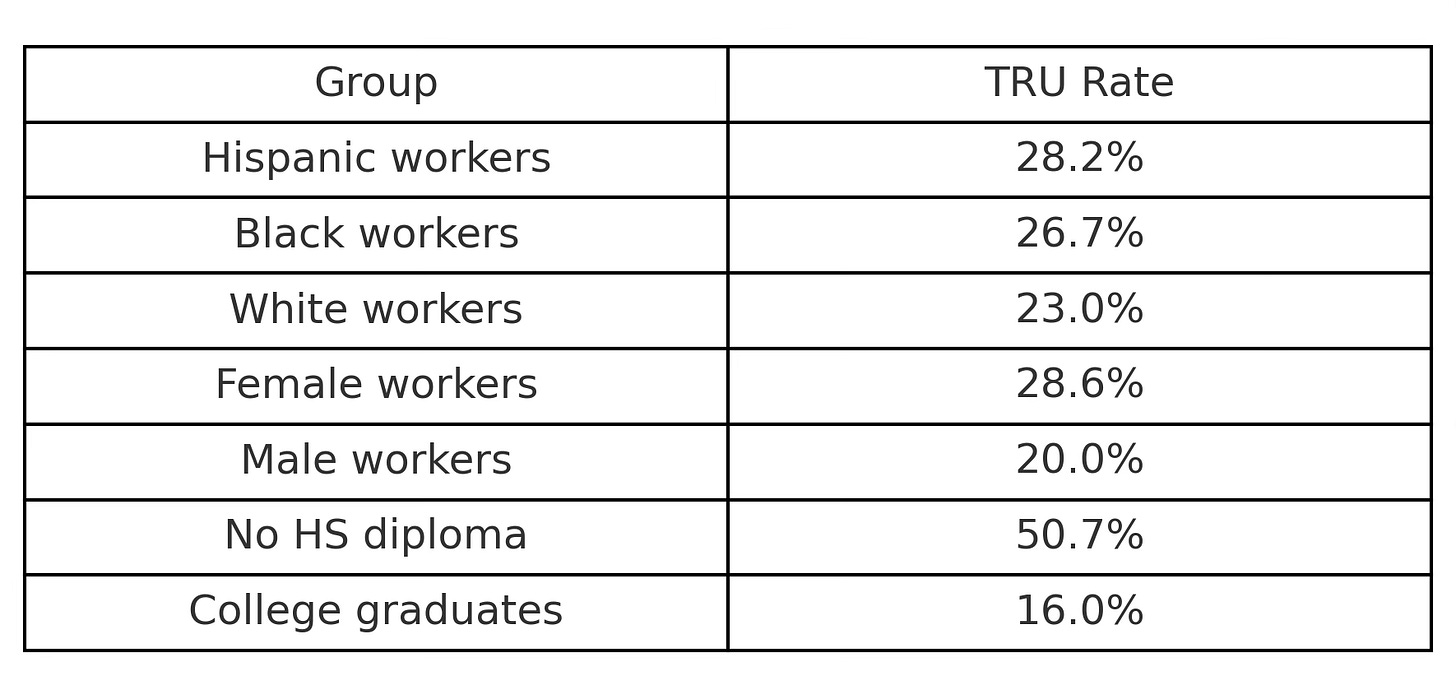

Now look at who’s most affected:

These are not random outliers. These are systemic patterns. They reveal what economists call “labor market segmentation,” though a more honest term might be structural exclusion.

The Federal Reserve continues to hold rates at 4.25–4.5% and calls the labor market “solid.” Yet wage growth for low-income workers lags inflation. Prices are up. Consumer confidence is down. Households are getting squeezed.

Tariffs like the 25% duties on auto parts are pushing prices higher. Every car built in the U.S. contains imported parts. The average price increase? Roughly $4,000 per vehicle. And that pain extends to nearly every product category—tools, diapers, detergent, toys.

Even Hasbro says prices are going up. About 90% of baby products sold in the U.S. are made abroad. That means American families will feel the impact.

Here is what functional unemployment implies. Many of the “employed” are in survival mode. They can’t build savings. They can’t afford medical emergencies. They delay having children. They skip meals. They fall behind on rent.

Yet because they worked one hour last week, they don’t count as unemployed.

If the Fed believes unemployment is low, it may hike rates unnecessarily. Ludwig warns that this will “lead to serious job loss” for the working class. If Congress believes the labor market is strong, it might slash social programs under the mistaken idea that support is no longer needed.

A job that doesn’t pay enough to live isn’t a job. It’s a debt trap dressed as opportunity.

Here’s how the gap between perception and reality has evolved since 2020:

So what would a sane labor policy actually look like?

They must begin by adopting metrics that reflect economic reality, not political convenience. Metrics like TRU.

They must prioritize job quality—not just job quantity. That means encouraging full-time, living-wage work, and rewarding employers who offer it.

They must recognize the deep demographic gaps in labor market access and respond with targeted training, childcare support, and anti-discrimination enforcement.

They must rethink inflation metrics. The CPI isn’t telling the full story. LISEP’s Minimal Quality of Life index shows that costs for working families have risen far faster than CPI reflects.

They must realign fiscal and monetary policy to focus on distribution, not just aggregate growth. A rising GDP that leaves the bottom 60% behind is not success.

Above all, they must stop pretending the official unemployment rate tells the whole story. It doesn’t.

An economy that produces 4.2% official unemployment and 24.3% functional unemployment isn’t healthy. It’s hiding its sickness behind a statistical illusion.

Until we confront the real numbers, we will never solve the real problems.