Taxed Like a Threat, Treated Like a Need

50% tariff on copper the U.S. can’t stop importing.

Here we go again.

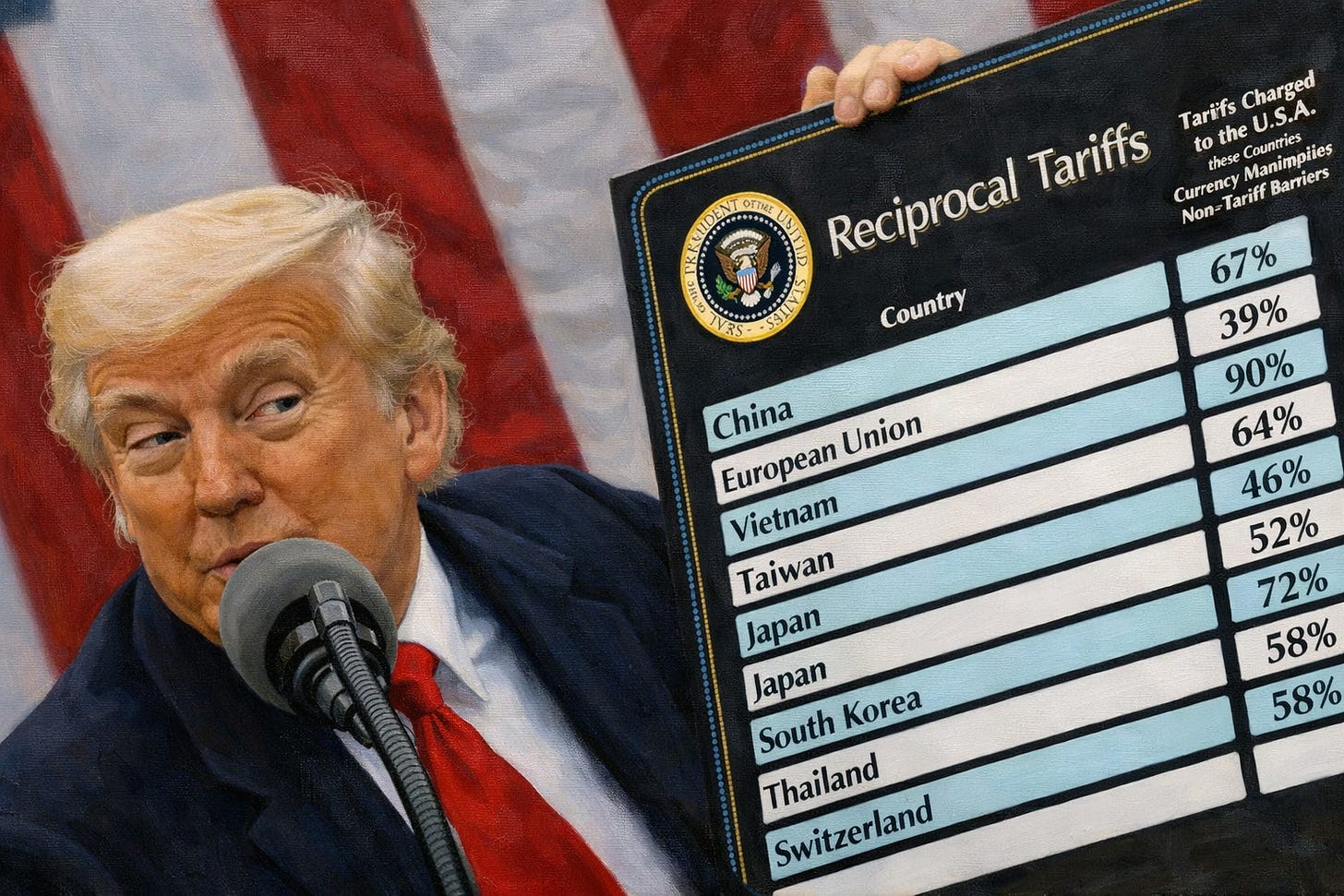

Donald Trump, never one to pass up a good show, has announced a 50% tariff on copper imports during a cabinet meeting. Within hours, copper futures surged over 10 percent to reach all-time highs. Just the suggestion of supply disruption is now enough to send markets spinning.

But behind the noise is a familiar pattern. Economic self-sabotage dressed up as strength, policy repackaged as performance, and the old habit of manufacturing conflict for applause.

Trump, in classic form, delivered the announcement with dramatic simplicity. Today, we’re doing copper he said, like a host unveiling a surprise contestant. The move is framed under the broad national security banner of Section 232 trade law. It’s another entry in his ongoing push to refashion the American economy through blunt-force protectionism.

The immediate focus is Canada, America’s second-largest source of copper after Chile. In 2023, Canada exported $9.3 billion worth of copper and related products, with over half of that heading to the U.S. That’s $4.8 billion in trade about to get significantly more expensive. The numbers are clear, even if the policy logic isn’t.

The fallout won’t land evenly. British Columbia, responsible for most of Canada’s copper production, won’t feel much impact. Its copper is largely bound for Asia. Teck Resources, based in Vancouver, doesn’t sell copper concentrate or refined copper into the U.S. They’re effectively out of reach.

Quebec is another story. That’s where Glencore operates the Horne Smelter and Canadian Copper Refinery, long-standing facilities employing hundreds and processing tens of thousands of tonnes each year. These are the operations now under pressure.

Pierre Gratton, head of the Mining Association of Canada, called the move very concerning for Quebec. But more revealing was his point about the likely beneficiaries: Chinese refiners, already producing copper at lower costs. A policy intended to defend domestic industry could end up strengthening its biggest rival.

North America’s copper system is tightly integrated. Raw ore mined in Canada is often refined locally, then sold to U.S. manufacturers. Those firms will now face a 50 percent tariff on the same material they’ve always used, while Chinese producers continue supplying global markets at more competitive prices. This is not strategic realignment. It’s a tax on your own supply chain.

Markets reacted exactly as expected. Price spikes may sound good for American miners, but the reality is more complicated. The U.S. produces about 1.1 million tons of copper annually, yet smelting capacity has been in steady decline for decades. America now refines less copper than Kazakhstan, and just half as much as Zambia. Resources in the ground are meaningless without the infrastructure to process them. This tariff ensures that U.S. manufacturers will keep paying more for the same foreign-refined copper.

The core flaw is familiar. Tariffs imposed without building domestic capacity simply raise costs and shift leverage. The CHIPS Act, despite its imperfections, at least tried to create a foundation before introducing protectionist measures. The copper tariff flips that order. It imposes penalties before offering alternatives.

And the timing only deepens the impact. Sectors like housing, electronics, automotive production, and utilities all depend heavily on copper. Costs will rise across the board, just as broader economic conditions begin to soften. Electric vehicle manufacturers, already dealing with fragile supply chains, now face another layer of pressure. For an administration claiming to revive U.S. manufacturing, this is a strange way to help.

So far, Prime Minister Mark Carney’s government has held off on any formal response, likely waiting for more clarity. But precedent suggests Canada won’t sit still. The last time Trump used tariffs on steel and aluminum, Canada responded quickly with countermeasures and domestic relief. With trade negotiations set to wrap by July 21, this copper move looks more like a bargaining tactic than a policy designed to last.

Trump’s wider strategy is now taking shape through three distinct tariff categories: national security-based Section 232 actions, border tariffs aimed at non-CUSMA goods, and retaliatory measures that were temporarily shelved after April’s market drop. Each has its own political role, but the economic effect is consistent. These are taxes, wrapped in rhetoric, landing squarely on American businesses and consumers.

The copper move is part of the pattern. A big announcement, market volatility, headlines that suggest bold action, followed by a fog of uncertainty. Questions about exemptions, implementation, and existing contracts remain unanswered. For companies trying to plan ahead, ambiguity is a cost in itself.

This also highlights a basic misunderstanding of how global manufacturing operates. Industrial capacity doesn’t move with a signature. Complex supply networks were built over decades, and disrupting them without alternatives in place only raises input costs while leaving foreign competitors untouched.

The tariff also sets a precedent that will be hard to contain. If copper qualifies for national security protection, other sectors could follow. Trump has already hinted at semiconductors and pharmaceuticals. In each case, the pattern will likely repeat. Higher costs, minimal domestic benefit, and continued reliance on foreign inputs.

Meanwhile, Chinese refiners are poised to benefit. The North American copper supply chain, developed through long-term cooperation, faces disruption that may take years to repair. U.S. manufacturers, already squeezed, will now operate at a further disadvantage while others continue trading freely.

This is the cost of treating trade policy like campaign content. The copper tariff may generate attention and spark price movement, but it does little to resolve the structural problems it claims to address. Canadian exporters will take a hit. American industry will take a bigger one. What looks like a tough stance from the podium amounts to a new burden on U.S. producers, workers, and consumers.

Copper may be trading at record highs. But for American industry, this move is not a breakthrough. It’s a bill, one that arrives disguised as strength, and paid for by everyone else.