Substations, Not Silicon Valley, Decide Who Wins

How grid bottlenecks, nuclear lifelines and private transmission lines now sort America into winners and losers.

America’s future is being decided by three things: megawatts, substations, and waiting lists. Everything else is background noise.

For years, the country pretended it had hacked physics. GDP climbed, electricity demand barely moved, and the story was that the economy had somehow dematerialized. LEDs fixed lighting. Heavy industry caught a flight to Asia. Software ate the world and handed the grid the bill.

Power turned into an afterthought. Like desks. Or printer cartridges.

That illusion died around 2023.

The load curve is now bending up, fast. AI data centers that never sleep. Government money dragging factories back onto the map. Cars, trucks and heating systems dumping their fuel tanks and plugging in. The old question was where is the talent. The new one is brutal: where are the electrons.

Texas is the loudest test case. Industrial power is cheap, projects keep slamming into the system, and ERCOT is improvising its way through record demand. The state sells a seductive story: lots of wind and solar, quick hookups, big dreams.

There is a footnote.

Scarcity pricing turns heat waves into financial knife fights. Winter Storm Uri is still in the rear-view mirror. People froze while the market went to graduate school.

Austin’s answer is the Big Beautiful Bill, which pays gas plants to sit on standby and rewards anything that can show up on demand instead of when the weather feels generous.

So yes, Texas offers a discount.

It is also a live experiment in hedge or die.

Risk-hungry capital loves it. Risk-averse capital looks at the volatility chart and quietly books flights to other zip codes. The grid has become a personality test for CFOs.

Hovering over everything is Artificial Intelligence. The single most obnoxious new customer in modern grid history.

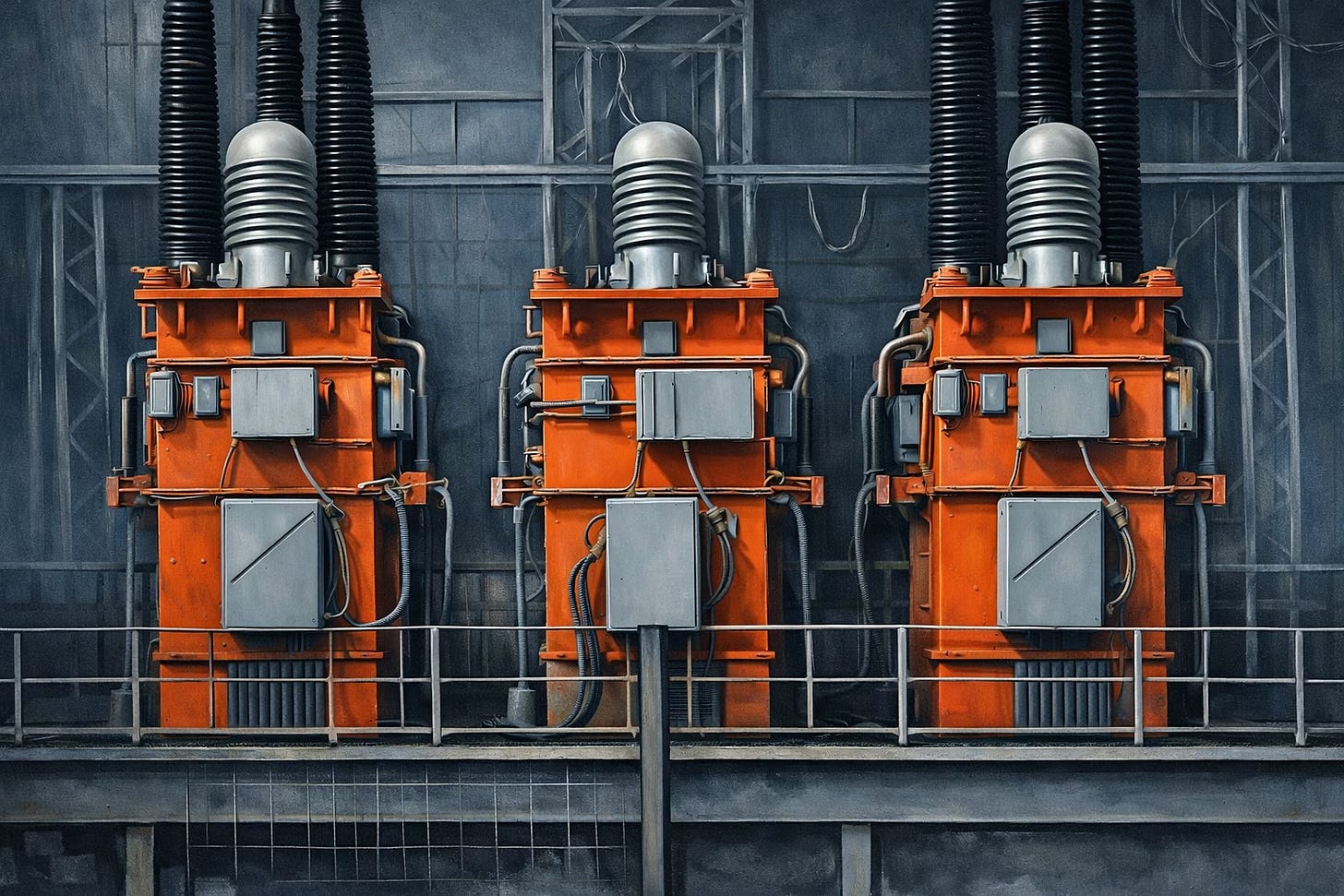

Data centers used to chase fiber and office workers. That romance is over. AI clusters chase substations and interconnection rights. Full stop.

These loads do not flex. A large training complex runs flat out, twenty four hours a day. It does not care if the wind fades or a cloud parks itself over the solar farm. That puts it directly in line with hospitals, water systems and every process that cannot go dark without real consequences.

Someone loses that fight.

It will not be the trillion-dollar hyperscaler with a lobby shop and a friendly tax credit.

So big tech stopped acting like a normal utility customer and started shopping for entire power plants.

Microsoft’s Three Mile Island deal is the blueprint. An 835 megawatt reactor, previously shut as uneconomic, is being pulled back into service on the back of a long contract and federal nuclear credits. The plant gets a new life. The surrounding grid gets a little help. Microsoft gets a private moat of clean, predictable electricity.

Then comes the AWS attempt in Pennsylvania. A data campus right next to the Susquehanna nuclear plant, with plans to pull nearly a gigawatt behind the meter and skip the shared grid as much as possible. FERC stepped in, listened to utilities about reliability and cost shifts, and killed the move.

The question underneath does not disappear: who gets to own the reliable part of the grid.

Google’s play with Kairos Power and the Tennessee Valley Authority points to the next iteration. Hundreds of megawatts of advanced reactors penciled in for one region that clearly intends to become a nuclear-backed industrial fortress while others juggle intermittent resources and peaker plants.

That is not just climate policy. That is territorial control.

While tech giants hunt captive electrons, the physical economy is redrawing its own map around the same logic. The Battery Belt from Michigan through Ohio and Kentucky into Tennessee, Georgia and the Carolinas is turning into one continuous EV and battery complex.

At the northern end sit legacy auto skills and suppliers. Move south and the pitch changes: lower wages, weak unions, big tracts of land, and workforce programs built like custom software for whichever megaproject signs next. Georgia throws a deepwater port and rich incentives on the table. North Carolina adds lithium deposits plus Defense Department money for mining and processing.

The message is simple: there is talent, there is land, and the power bill will not kill the business model.

Miss the power part and nothing else matters. A gigafactory without reliable megawatts is just an expensive warehouse.

Then there are the real electricity addicts. Aluminum smelters. Hydrogen plants. Operations where electrons are not a cost line, they are the main ingredient.

Century Aluminum’s stalled smelter in Kentucky says everything that needs to be said. Half a billion dollars in federal support. A preferred state. Big speeches. And still no final site. Industrial rates have drifted above what a smelter can stomach, and a green requirement blocks the easy path of doubling down on cheap coal. The company is chasing a power deal that is clean, cheap and firm at the same time.

That combination mostly lives in PowerPoint.

Hydrogen hubs are even more nakedly political. Federal dollars slice the country into chosen regions and everyone else. Texas Gulf Coast builds on existing hydrogen pipes, salt domes and refineries. Appalachia is told to turn shale gas into blue hydrogen with carbon capture slapped on top. The Pacific Northwest gets a hydro-flavored green story and a reminder that its grid can only take so much.

Remove the 45V hydrogen credit and half the hub map evaporates in an afternoon.

Petrochemicals are walking down the same path. E-cracking replaces gas-fired furnace heat with giant electric elements. Climate accountants smile. Grid planners do not. The Gulf Coast chemical sector ties itself even tighter to the regional power system and its vulnerabilities.

Everything eventually clogs the same drain: the interconnection queue.

This is the place where all the big dreams sit while transmission planners decide whether the wires can handle them. In PJM, the queue swelled to the point where the operator essentially slammed the door, rewrote the rulebook and pushed realistic connection dates toward the end of the decade.

A politician can announce as many innovation hubs as desired. If the queue says 2029, the project lives on slide decks.

Texas plays the opposite game. Meet technical requirements, pay up, and connect. Congestion and curtailment are future problems. That connect-and-manage philosophy, paired with huge wind and solar resources, is why so many factories and data centers accept ERCOT’s chaos.

Speed to power beats elegant planning. Every time.

Since public transmission lines move at the speed of lawsuits and county meetings, private capital is building its own high-voltage shortcuts. SunZia moves New Mexico wind toward Arizona and California. Grain Belt Express tries to shove Kansas wind into Midwestern grids. TransWest Express drags Wyoming wind toward the Southwest.

Along those routes, certain junctions quietly turn into jackpots. Plug in at the right node and a project sidesteps years of congestion misery. Those spots are the new river ports and railheads. Even if they still look like anonymous fenced yards in the middle of nowhere.

Federal tax credits, tariffs and industrial bills lay another grid over the map. Credits for clean manufacturing, hydrogen and nuclear tip marginal projects into viability. High tariffs on Chinese EVs, batteries and steel gently but firmly push foreign manufacturers to build on U.S. soil if they want the consumer market.

That is how a Korean auto giant ends up dropping an enormous EV complex into Georgia and not into California. The decision is not vibes. It is arithmetic: tariffs, subsidies, and a utility that can promise megawatts on schedule.

Everyone knows these incentives can shift with one election, which creates a different kind of pressure. Developers rush to break ground, safe-harbor their credits and lock in their deals before the political jukebox plays a new song. Regions that can say yes, power will be there collect the projects. Regions that cannot get op-eds.

Then comes construction reality. Money is expensive again. Steel and concrete cost more. Skilled labor is short. Building on a blank field is painful. So brownfield sites suddenly look like bargains.

Shuttered coal plants and old steel mills come with roads, rail, water intake and thick transmission already attached. Environmental headaches, sure. But in a world where the interconnection queue is backed up for years, that old skeleton is a cheat code.

Strip everything down and the rulebook for American industry has flipped. The 20th century rule was simple: follow the labor.

That rule is dead.

The new rule is follow the power.

Energy-rich interior states with permissive regulators scoop up data centers, hydrogen projects and any operation that eats megawatts for breakfast. The Battery Belt mixes tolerable prices, malleable labor markets and aggressive incentives to corner EVs and batteries. Nuclear-heavy regions quietly sit on the best future addresses for high-value digital infrastructure.

The rest of the country gets very good conference panels.

By the early 2030s, the United States will look less like one unified grid economy and more like a patchwork of fortified industrial islands. Clusters built around dedicated reactors, bespoke renewable microgrids and private transmission that can walk away from the larger system when it falters.

In that world, any serious project asks three questions. How much does the power cost. Who controls the switch. How long is the line to plug in.

Ports and railroads wrote the last industrial map. Substations and transmission corridors are writing the next one. Anyone still planning the future as if energy is a detail is already on the wrong side of the fence.

References:

Energy Costs and Constraints Are Reshaping Site Selection in 2025

Electricity Rates by State (November 2025)

US primary aluminum growth a ‘function of energy’

Texas Electricity Costs Are Rising: How the Big Beautiful Bill Is Shaping the State’s Energy Future

Forecast wholesale power prices and retail electricity prices rise modestly in 2025