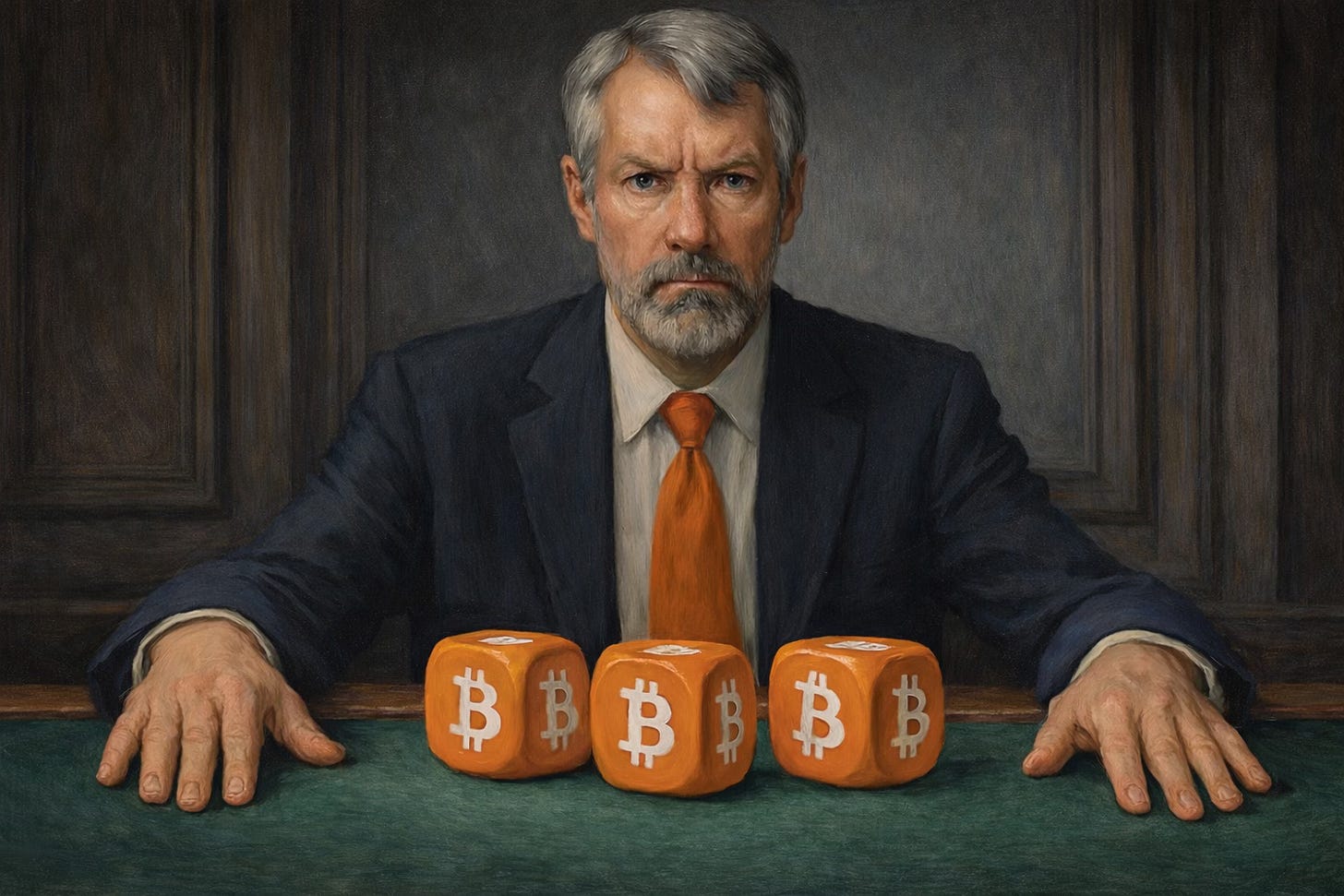

Strategy Inc: A Corporate Bitcoin Ponzi, Up Close

$363 million in profit, $640 million in promises, and a market praying MSCI looks the other way.

Strategy Inc. announced in mid-November that it owned 649,870 Bitcoin. That’s 3.26% of everything that will ever exist, purchased with $48.4 billion in borrowed money.

The company’s Executive Chairman called it volatility harvesting.

It’s a Ponzi-like capital structure dressed in corporate finance couture, and the mathematics strongly suggest it cannot survive past March 2026.

The company generates $363 million a year in gross profit from its software business. It owes $640 million annually just in preferred stock dividends.

That’s a $277 million structural deficit before touching debt service or buying another Bitcoin.

They filled that hole in 2025 by raising $19.5 billion in fresh capital. Not to grow. To pay the carry on previous capital raises.

When Bernie Madoff does this, it’s fraud. When a Nasdaq-listed company does it, it’s innovation.

The magic trick worked like this.

Strategy’s stock traded at 1.5x to 2.5x the value of its Bitcoin holdings throughout 2025. This wasn’t sentiment. It was the business model.

When your stock trades at double your asset value, you can issue equity to buy more assets, which then get valued at double, which lets you issue more equity.

Perpetual motion fueled by the belief it would never stop.

The mechanics were straightforward. Issue convertible debt at 0.42% interest (essentially free money). Issue equity when the premium spiked. Layer in perpetual preferred stock with variable rates. Use everything to vacuum up Bitcoin while passive index funds were forced to keep buying your stock simply because your market cap kept growing.

Michael Saylor called this torque.

What he built was a recursive accumulation loop that worked flawlessly until the conditions sustaining it began to fracture.

Buried in that capital structure sits an instrument so dangerous it makes subprime CDOs look conservative: the Series A Perpetual Stretch Preferred Stock, ticker STRC.

The fatal design feature: it’s engineered to trade at exactly $100.

When it falls below that price, management must raise the dividend rate to attract buyers back. The rate started at 9% in July. By November, it hit 10.5%.

There’s a floor but no ceiling.

See the trap?

If confidence cracks, investors sell. Price drops below $100. Management raises the dividend rate. Cash burn accelerates.

To fund higher dividends, the company must either issue dilutive equity or sell Bitcoin. Either action signals distress, triggering more selling, requiring even higher dividend rates.

This is the identical structure that killed Auction Rate Securities in February 2008. Rates spiked to penalty levels and issuers drowned in interest costs. The securities became zombie instruments trapped in portfolios with no exit.

Strategy is carrying that bomb right now while insisting everything is fine.

On October 10, 2025, at 20:34 UTC, MSCI announced it was extending a consultation on excluding companies with over 50% of assets in digital currencies from its global equity indices.

Strategy’s Bitcoin holdings represent 77% of total assets.

Sixteen minutes later, the Trump administration announced new tariffs.

The crypto market imploded. Bitcoin crashed from $126,000 to $104,000. Nearly twenty billion in leveraged positions evaporated. Order book depth collapsed.

The MSCI announcement vanished in the chaos.

For forty-two days, it sat buried in regulatory filings while the market forgot it existed.

Then, on November 20, JP Morgan published a research note resurrecting the stale news: MSTR faces a high risk of being removed from the NASDAQ 100 and MSCI indices.

The market panicked. Strategy’s stock dropped 50%. Bitcoin fell 15%.

JP Morgan simultaneously hiked margin requirements on Strategy shares to 95%, forcing liquidations.

The timing destroyed the one mechanism that made the entire structure viable: the equity premium.

In response to liquidity concerns, Strategy management claimed the company has 71 years of dividend coverage assuming flat Bitcoin prices.

Simple division: $70.9 billion in Bitcoin divided by $1 billion in annual obligations.

This claim is economically incoherent.

It assumes you can sell a billion dollars of Bitcoin annually with zero market friction. Strategy holds 3.26% of total supply. October 10 proved that selling pressure causes exponential price declines.

During that crash, the cost of selling became astronomical as market makers withdrew. For a holder of Strategy’s size, the quoted price and the realizable price diverge catastrophically the moment they become a net seller.

Also: selling Bitcoin triggers 21% corporate tax on realized gains. To net a billion for dividends, they’d need to sell $1.3 billion in assets.

And here’s the thing. The premium exists because investors believe management will accumulate forever.

The second they become distributors, the premium evaporates and the funding model breaks. You cannot monetize scarcity while simultaneously increasing supply.

Material Bitcoin sales also likely trigger cross-default provisions across the entire capital structure.

The 71-year claim is a spreadsheet calculation divorced from market reality.

Strategy Inc. hasn’t done anything illegal.

They’ve attempted something conceptually impossible: using corporate liability structures to execute sovereign monetary operations.

Bitcoin is optimized for infinite time horizons. Its value proposition assumes you can wait through 80% drawdowns because you have no mark-to-market liabilities.

Nations can do this. Billionaires can do this.

Corporations operating on quarterly refinancing cycles and monthly dividend payments cannot.

When capital markets close or asset values decline, sovereigns service obligations from tax revenue or print currency. Corporations must sell assets or restructure debt at the worst possible time.

Strategy tried to engineer around these constraints. But you cannot eliminate fundamental mismatches in time horizon, liquidity backstop, and market impact through clever structuring.

Late 2025 pushed multiple variables outside the equilibrium band at once.

Now the reflexive structure is inverting: falling prices reduce capital access, loss of capital access forces asset sales, forced sales pressure prices further.

MSCI’s decision publishes January 15, 2026. Index reconstitution occurs in February.

If MSCI reverses course following industry pressure, Strategy rallies and survives. This requires explicit policy intervention.

Probability: maybe 15 to 20 percent.

More likely, call it 60 to 70 percent, MSCI exclusion proceeds. JPMorgan estimates nearly three billion in forced selling from passive funds. If other indices follow, total outflows could hit eight or nine billion.

Strategy’s stock trades at 0.6x to 0.7x net asset value. Accretive equity issuance becomes impossible.

The company enters managed deleveraging, selling 1 to 2 percent of holdings monthly.

The Bitcoin vacuum becomes a Bitcoin faucet.

Worst case: MSCI exclusion combines with credit freeze or Bitcoin crash below $70,000. Strategy faces immediate liquidity crisis requiring forced liquidation. The preferred stock death spiral accelerates as par breaks and dividend rates spike past 15%.

Covenant breaches trigger cross-defaults.

The mechanics overwhelmingly favor the middle path: slow, grinding deleveraging rather than clean survival or immediate collapse.

Bitcoin will be fine.

The real question is whether private corporations can construct parallel monetary reserves using public capital markets infrastructure designed for operating companies.

The answer is no. Not at this scale, not with these tools, not without sovereign backstops.

Index providers aren’t engaging in a coordinated attack. They’re performing basic risk management on instruments that blur the line between equity and investment fund.

They did the same thing with Business Development Companies in 2014. The precedent is clear.

What makes Strategy’s situation unique is the feedback loop: the company that led the speculative attack on fiat currency is now vulnerable to being liquidated by the very volatility it sought to harvest.