No, China Is Not the Adult in the Room

Behind the calm rhetoric on debt and growth is a system running 290% debt-to-GDP and rolling over liabilities it can’t pay back.

TL;DR:

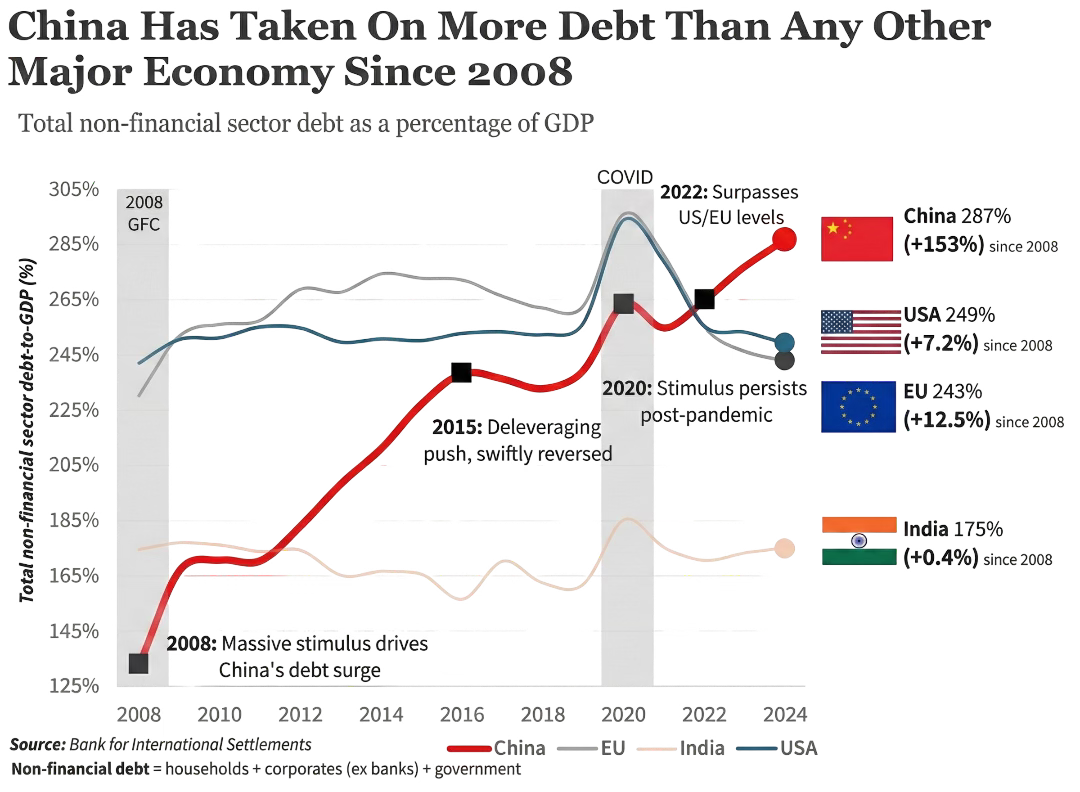

China’s total debt now exceeds 290% of GDP—higher than the US and Euro Area.

The low public debt narrative was an accounting illusion built on thousands of off-balance-sheet corporate shells.

While the West inflated away pandemic debt, China fell into deflation, making its debt burden heavier in real terms.

For sixteen years, the global financial establishment bought a story that was too convenient to be true.

China: the disciplined saver, the prudent banker, the nation with fiscal space to spare while the West drowned in debt. Wall Street nodded along. Davos panels cited the numbers. The IMF built entire risk models around Beijing’s supposed capacity to bail out the global economy.

But that story just died.

According to Bank for International Settlements data, China’s total non-financial sector debt has hit roughly 290% of GDP. That’s higher than the United States (around 245%) and the Euro Area (about 230%). This is the Great Crossover. The supposed lender of last resort is drowning.

How did everyone miss this?

Simple. Everyone was reading the wrong balance sheet.

Beijing’s official government debt sits at a tidy 24% to 50% of GDP. This is the figure trotted out at every international forum. American politicians look at their own 100%+ ratio and wonder how Beijing pulled it off.

They didn’t.

They moved the borrowing off the government’s books and called it something else.

The secret lies in thousands of corporate entities called Local Government Financing Vehicles. In the early 2000s, China’s budget laws prohibited local governments from borrowing directly. So they created technically private companies that exist solely to borrow money on behalf of the state.

These corporations built highways, airports, high-speed rail lines, entire ghost cities. All financed by debt that never appeared on any government ledger.

When the IMF applies its augmented methodology (the one that captures what governments actually owe rather than what they claim), China’s public debt explodes to roughly 124% of GDP.

Functionally identical to the United States.

But it gets worse.

Because LGFV debt gets categorized as corporate in official statistics, China’s non-financial corporate debt now stands at 160% of GDP. Double the American level. This is debt that generates no profit, funds no productive enterprise, and survives only because state-owned banks are ordered to keep rolling it over.

To understand how China built this debt mountain, trace four phases.

Phase I was the 2008 response to the Global Financial Crisis. When Western export demand collapsed, Beijing unleashed a stimulus package worth 4 trillion yuan. LGFVs borrowed against rising land values to build roads, bridges, industrial parks. Anything with a ribbon to cut and a GDP number to boost.

The stimulus maintained 8%+ growth while the West stagnated. But it institutionalized a model where debt accumulation became decoupled from economic productivity.

Phase II was the shadow banking explosion of 2012 to 2016. When regulators tried to rein in formal bank lending, demand for credit remained insatiable. Banks moved the loans off their balance sheets through trust companies and securities firms.

Retail investors poured money into Wealth Management Products promising high yields, unknowingly funding risky property projects with no hope of returns.

The credit intensity of growth spiked. It now took 6 to 9 units of new credit to generate a single unit of GDP growth, up from roughly 3 during the boom years.

Phase III was Xi Jinping’s deleveraging campaign starting around 2016. Beijing recognized the ticking time bomb. The slogan houses are for living in, not for speculation signaled a genuine attempt to deflate the bubble. Regulators cracked down on shadow financing.

But the campaign collided with the US-China trade war.

With exports under pressure, Beijing couldn’t afford to let domestic credit fully contract. The form of debt shifted from shadow to formal. The total stock kept climbing.

Phase IV is where the Great Crossover crystallized.