Margins Are Fine. Households Are Not.

Earnings up, eggs up, excuses louder.

Americans are paying a tax they don't realize they're paying. Call it a tariff if that makes everyone feel better.

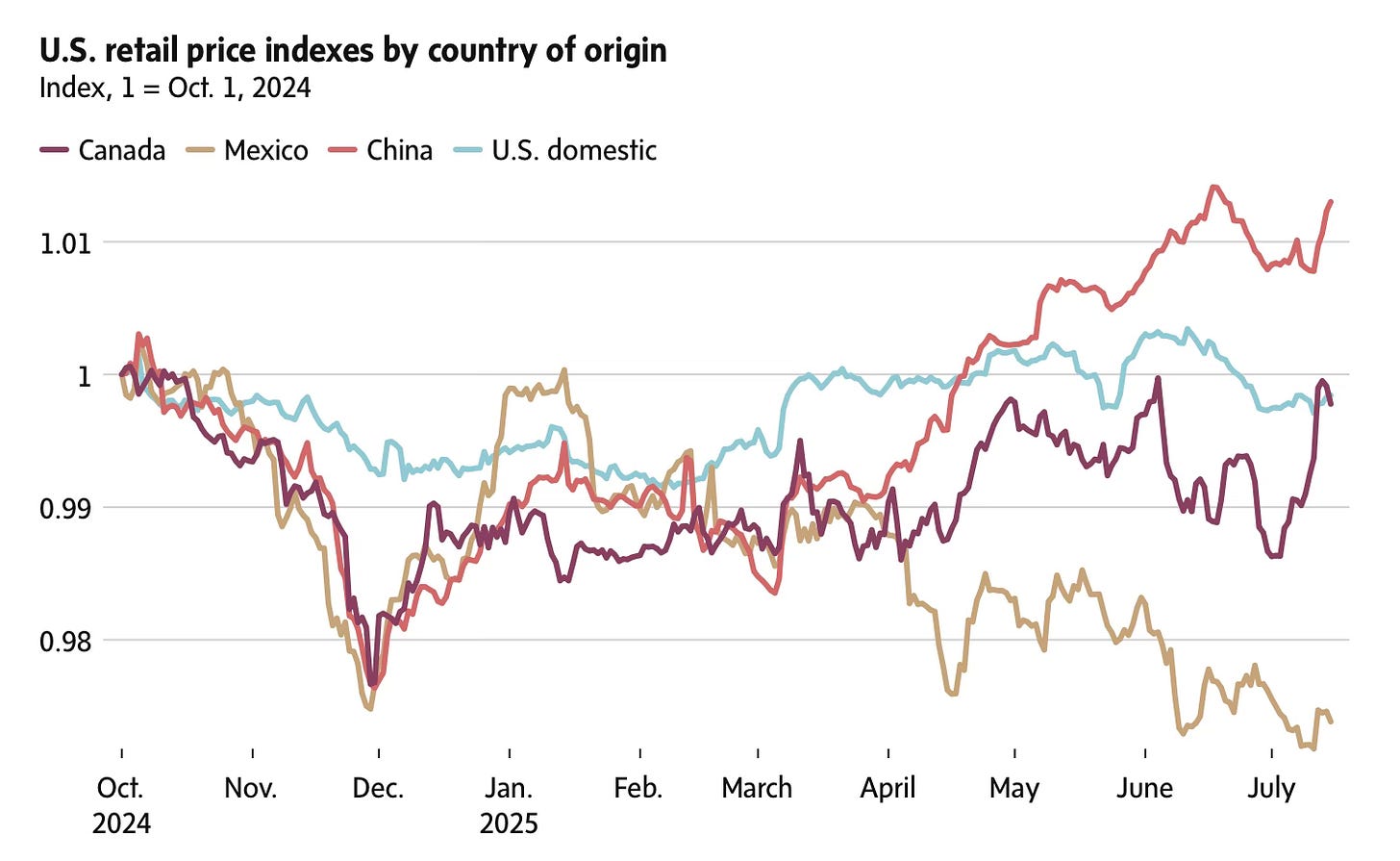

The Harvard Business School Pricing Lab's been tracking this. Alberto Cavallo's team monitors over 300,000 products across major retailers in real-time, using AI to trace country of origin. Like having a thermometer stuck directly into the economy's pricing bloodstream. Chinese goods are up about 1% so far. Doesn't sound like much. Yet.

Here's what's wild. People are watching their grocery bills explode past $500 a month, electric bills doubling, tracking egg prices like day traders track Tesla. Yet somehow they're convinced China's writing checks to Uncle Sam.

GM's already paid $1.1 billion in tariffs this year. Not China. Not Mexico. General Motors, an American company expecting to hit $4-5 billion by year's end. General Electric coughed up half a billion.

The Harvard data reveals something else: domestic products are creeping up too. When your competitor's costs jump 25% overnight due to tariffs, you don't keep prices flat out of patriotic duty.

June’s inflation hit 2.7% annually. Everyone’s trying to parse out tariffs versus everything else.

Trump's apparently planning to "unleash tariffs for about 200 countries" on August 1st, just in time for holiday shopping season. Walk into any store now and you'll see those surcharge notices multiplying. Five dollar "tariff fees" here, twenty percent markups there. At least some companies are being transparent about it. Most just quietly adjust the sticker price and let consumers blame Biden, or corporate greed, or Mercury in retrograde.

The molybdenum situation deserves more attention.

China controls that market. Steel production needs it. They're restricting exports now, along with a bunch of rare earth elements. Steel tariffs mean nothing if you can't get materials to make steel. The BRICS countries sit on most of the world's critical minerals. America's picking trade fights with all of them simultaneously.

The cognitive dissonance in public discourse is almost beautiful.

People complaining about corporate greed causing inflation while supporting policies that hand corporations a perfect excuse to raise prices.

"Sorry folks, tariffs made us do it!"

Check the earnings reports though. Margins looking pretty healthy for companies supposedly getting crushed by import costs.

UBS economists calculate the jump from 2.5% average tariffs to 16%. The highest effective rate since 1903. Gilded Age trade policy meets 21st-century supply chain.

The front-loading phenomenon creates this weird suspended animation. Most importers stocked up on pre-tariff inventory to last till the new year. Everyone's got time to convince themselves it won't be that bad.

Aluminum can prices have become an economic indicator now. Campbell's warned about soup can costs. When Big Soup starts sweating, you know the situation's serious. The whole project was sold as bringing manufacturing back to America. Instead, everything just gets more expensive while China pivots to selling to literally everyone else on the planet.

The receipts are getting harder to read. Not because of complexity.

MAGA TRASH don’t even realize they are cheering on raising their own taxes - Trump is a genius conman who convinced goobers complaining about taxes that they want to be taxed