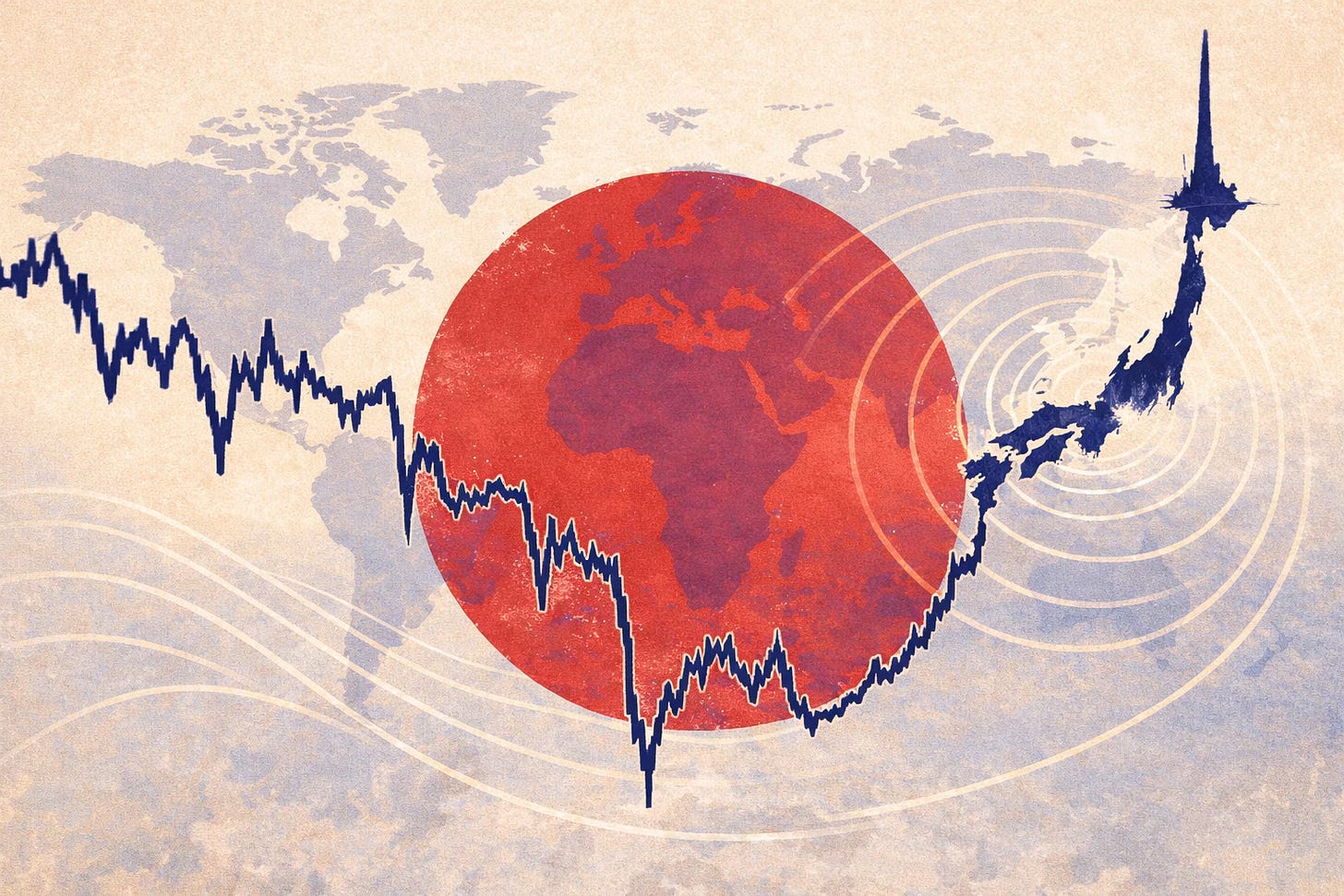

Japan Bond Yields Surge, Everyone's Problem

JGB yields explode, carry trade wobbles, and $130 billion in Treasuries eyes the exit.

The forty-year Japanese government bond hit 4.22%. A record. First time any JGB cleared 4% in over thirty years.

Most people hear that and shrug. Bond yields. Whatever.

But this is how it starts. This is always how it starts.

And to be clear: this didn’t begin in January. Japan’s fiscal turn started months ago. January is simply when it stopped being a domestic story and started exporting volatility to everyone else.

On January 20th, a routine auction of 20-year Japanese bonds came in weak. Bloomberg called it lackluster. The market response was immediate and violent. Thirty and forty-year yields jumped 27 basis points in a single session. The ten-year hit levels not seen since 2008.

Japan. The country that built a reputation on quiet, boring debt. Suddenly shipping volatility to everyone else.

Finance Minister Satsuki Katayama was at Davos when it happened. She did what Japanese officials have perfected over three lost decades. She urged calm. She promised Japan will maintain fiscal sustainability while increasing spending.

Read that again. Maintain fiscal sustainability. While increasing spending.

Prime Minister Sanae Takaichi’s agenda is the problem. A record budget. A massive stimulus package. A two-year suspension of the food sales tax. Accelerated defense spending. The funding mechanism for all this? Nobody knows.

Yuuki Fukumoto of NLI Research Institute said it plainly: There is no clear funding source for the consumption tax cut, and markets expect it to be financed through government bond issuance.

So the plan is to cut taxes, increase spending, and finance the gap by issuing more of the exact bonds that markets are now refusing to buy at reasonable prices. Brilliant.

Saxo Bank called it Truss-esque. The comparison to Liz Truss’s 44-day UK catastrophe is not hyperbole. Unfunded promises. Bond vigilantes waking up. A government about to learn that markets enforce discipline when politicians refuse to.

Japanese life insurers dumped a record ¥822 billion in super-long bonds before the disastrous auction. They saw what was coming.

Foreign investors now account for 65% of monthly JGB transactions. Up from 12% in 2009. The patient domestic institutions are gone. Replaced by international traders with zero loyalty to the stable and boring narrative.

And there’s a major February 8th ballot coming. Local and by-elections that will be read as a referendum on Takaichi’s spending agenda. Takaichi wants a mandate for more spending. The opposition promises permanent elimination of the food tax.

Fiscal restraint is literally not on the ballot.

Here’s why this matters beyond Tokyo.

Japan holds $1.2 trillion in US Treasuries. Largest foreign holder. Citi warns the turmoil could force up to $130 billion in Treasury selling.

On January 20-21, it happened in real time. US thirty-year yields jumped toward 4.95%. UK gilts surged. Bloomberg’s diagnosis was blunt: The true accelerant to the Treasury and dollar selloff seems to be Japan.

The yen carry trade has been the world’s liquidity engine for decades. Borrow yen cheap. Buy everything else. Pump trillions into global markets.

August 2024 showed what happens when it hiccups. TOPIX lost 12% in a single day. The Nikkei had its worst crash since 1987.

That was just a warning shot. The trade recovered within days.

This time feels different.

The widowmaker trade, that famous bet on JGB weakness that killed speculators for thirty years, is finally paying off. Since Takaichi took office, super-long yields have risen about 80 basis points.

The joke stopped being funny.

Major governments of the major economies are living deficits… investors are starting to demonstrate that they’re not happy about that.

And the timing could not be worse. This is happening exactly as US deficits swell toward $2 trillion annually.

Great moment to lose a structural buyer.

The 'Perfect Storm?'

What a time to be alive! We are living in historic times. You know, I wouldn't mind being a bit... bored actually. Ennui ain't so bad. Well, not after one considers the alternative.