Iran’s Oil Power, Reversed

The quiet economic isolation of Iran and China’s quiet gain.

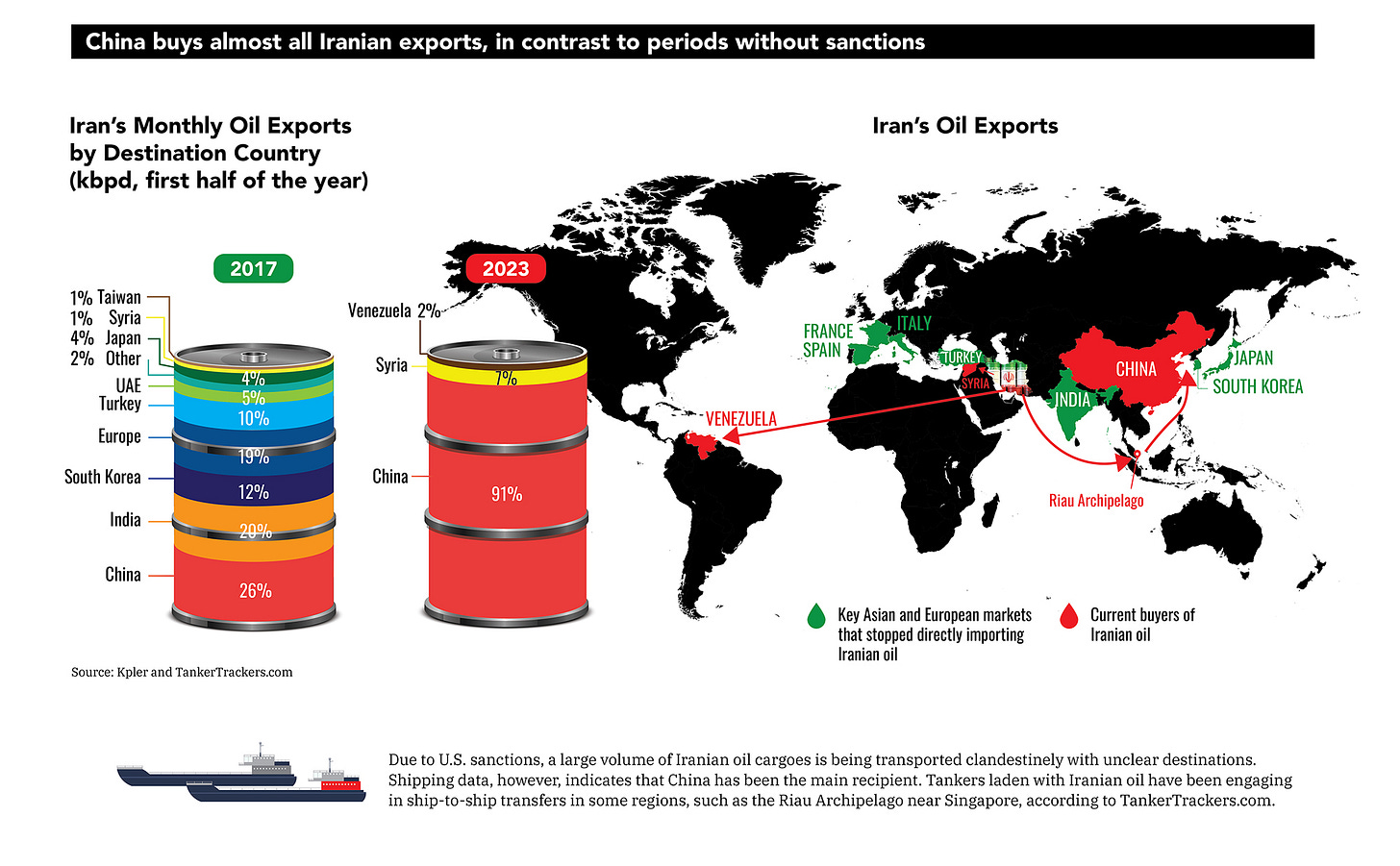

Iran used to sell oil like any normal country. Multiple buyers, competitive prices, steady relationships. Look at 2017: India bought 28%, China took 26%, South Korea 12%, Europe 19%. Everyone got a piece.

Iran has kept moving, slowly, away from where it once stood. Energy is where the shift becomes most visible.

By 2023, that spread collapsed into a single line item. China: 91%. Everyone else combined: maybe 9% if you’re generous with the math.

This visual captures how thoroughly Iran’s oil trade has narrowed under pressure.

The shift happened because sanctions work differently than people think. Washington didn’t stop Iranian oil exports. It made them progressively more expensive and risky. European refiners faced regulatory headaches. Asian importers worried about banking access. Insurance companies walked away.

China stepped into this gap. Beijing needed discounted crude and wanted to thumb its nose at American financial dominance. Iranian oil checked both boxes.

But friendship was never the point. China now dictates terms because Iran has nowhere else to go. Prices, payment schedules, delivery terms. All favor the buyer.

The mechanics are fascinating in their complexity. Iranian crude doesn’t sail directly to Chinese ports anymore. It gets transferred between ships near Southeast Asia, often with transponders switched off. The Riau Archipelago, just south of Singapore, has become a central waypoint for this shadow trade. Iranian tankers offload crude to ships sailing under different flags. The route is hidden in plain sight.

Chinese “teapot” refineries process this crude. These small, independent plants operate with minimal oversight and maximum flexibility. They can handle sanctioned oil without triggering the compliance systems that constrain larger refiners.

It’s a parallel energy market. The oil is real, the volumes substantial, but the legal framework stays deliberately murky.

Iran’s former customers adapted faster than Tehran expected. India increased imports from Iraq and the UAE. South Korea bought more American crude. Europe shifted to North Sea suppliers. The global system filled the gap.

Meanwhile, Iran’s regional influence has been steadily degraded. Israeli operations have hollowed out key proxy networks. Hezbollah leadership has been decapitated. Hamas capabilities have been systematically destroyed. Syria’s Assad can barely control his own territory.

The timing isn’t coincidental. Iran’s economic options narrowed as its strategic reach contracted. Fewer levers, less leverage.

China benefits from Iranian weakness but doesn’t want Iranian collapse. A desperate Iran might pursue policies that complicate Chinese interests elsewhere in the region. Beijing maintains relationships with Saudi Arabia, the UAE, and other Gulf states that dwarf its Iranian trade.

This creates an odd equilibrium. China provides just enough support to keep Iran functional but not enough to restore Iranian independence. Tehran gets sufficient revenue to avoid collapse but not enough to rebuild diversification.

The human cost stays buried in statistics. Iranian citizens face persistent inflation, currency devaluation, and reduced access to international goods. Professional opportunities shrink as international connections weaken.

Yet authoritarian systems often prove resilient when external pressure creates internal cohesion. Economic hardship gets blamed on foreign enemies. Limited options justify domestic restrictions. The resistance narrative has deep cultural roots in Iran.

The 2022 protests showed this narrative has limits. Iran’s young, educated population grows increasingly skeptical of official explanations for persistent economic problems. Future shocks could trigger similar dynamics.

China’s own economic challenges may affect its appetite for Iranian oil. Growth has slowed. Energy demand patterns shift toward renewables. Domestic pressures favor less dependence on unstable suppliers.

The broader lesson extends beyond Iran. Modern economic warfare doesn’t produce sudden collapses. It creates gradual erosion until target states operate within narrow constraints they never consciously accepted but can no longer escape.

Iran’s oil transformation illustrates this perfectly. What began as targeted sanctions evolved into comprehensive dependency on a single partner. The economy functions, but within parameters largely determined by Chinese interests rather than Iranian preferences.

That red barrel in the graphic wasn’t just a trade shift. It was a surrender of optionality. From 74% of buyers gone to one left standing. Iran didn’t just lose customers. It lost leverage.

Iran still pumps oil. China still buys it. What was once commerce has become reliance, and what looked like partnership now functions more like control.

The strangling happened so gradually that monthly statistics barely capture the transformation. But the strategic shift is complete. Iran now operates as China’s discount energy supplier rather than an independent regional power.

That outcome was likely inevitable. In the end, Beijing became the primary beneficiary.