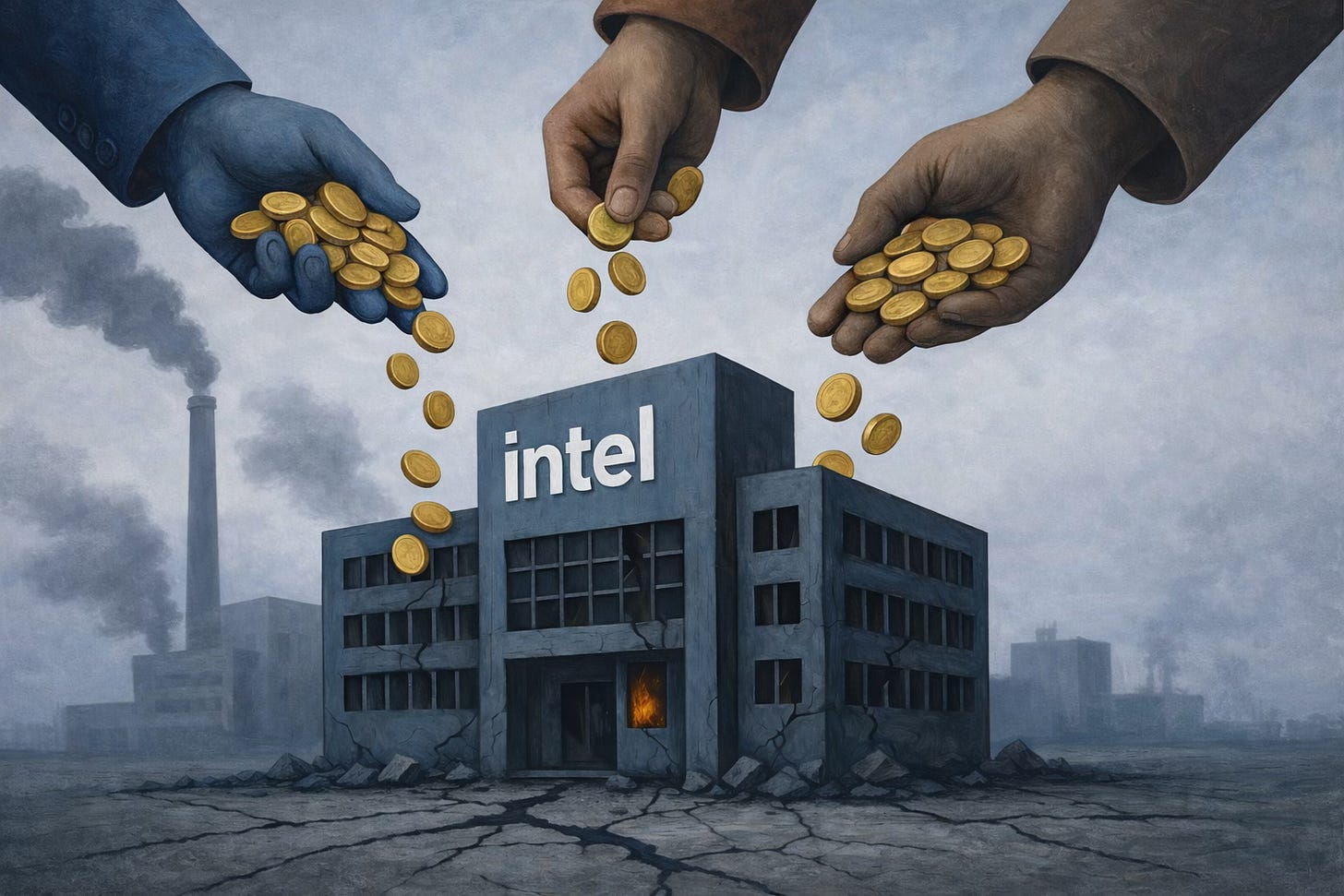

Intel: SoftBank’s Stake vs. U.S. Government Stake

Different motives but the same message that Intel cannot stand alone.

SoftBank just threw $2 billion at Intel. Twenty-three bucks a share for a company that lost $18.8 billion last year. First red ink since 1986.

No board seats. No guaranteed chip deals. Just money. Lip-Bu Tan framed it as confidence. Markets gave Intel a 6% pop in after-hours.

The bigger story is Washington. Trump world floating a plan to flip $10.9 billion in CHIPS Act grants into equity. Roughly 10% of the company. That’s not subsidy. That’s ownership.

And it comes after Trump demanded Tan resign over his China links. Then met with him anyway. Now talks about government equity.

When subsidies turn into shares, the diagnosis is obvious: Intel’s condition is worse than advertised.

The foundry bet was supposed to be the pivot. Ohio fabs pitched as the largest on earth. Still delayed. Zero anchor customers.

Nvidia worth $1.8 trillion. Intel stuck at $104 billion. TSMC still 18–24 months ahead on advanced nodes. Apple and Nvidia locked in with Asia. Intel moving at Washington’s speed, not the market’s.

SoftBank’s $2 billion buys maybe six months of runway. Nothing more.

A 10% government stake changes the model. Intel becomes a semi-state enterprise. Not unprecedented. The Pentagon already took $400 million of MP Materials. Treasury has floated cutting into semiconductor sales to China. Industrial policy is mutating into direct ownership.

Intel’s workforce already knows. 15,000 layoffs. About 15% of staff.

Debt-to-equity ratio at 47%. Capital costs per fab in the $15–20 billion range. Revenue down 1% while competitors post double-digit growth. Stock off 60% in 2024.

SoftBank is now Intel’s sixth-largest shareholder. Behind Vanguard, BlackRock, the passive giants that own it by default. A government stake at 10% would make Washington the largest active shareholder. That means influence over fab sites, supply chain calls, and customer exposure.

And once that door opens, it doesn’t stop at chips. Defense contractors. Rare earth miners. Critical infrastructure. Direct state equity in strategic firms starts to look normal.

SoftBank gets a stake. Washington gets leverage. Intel gets time.

Profitability still missing.