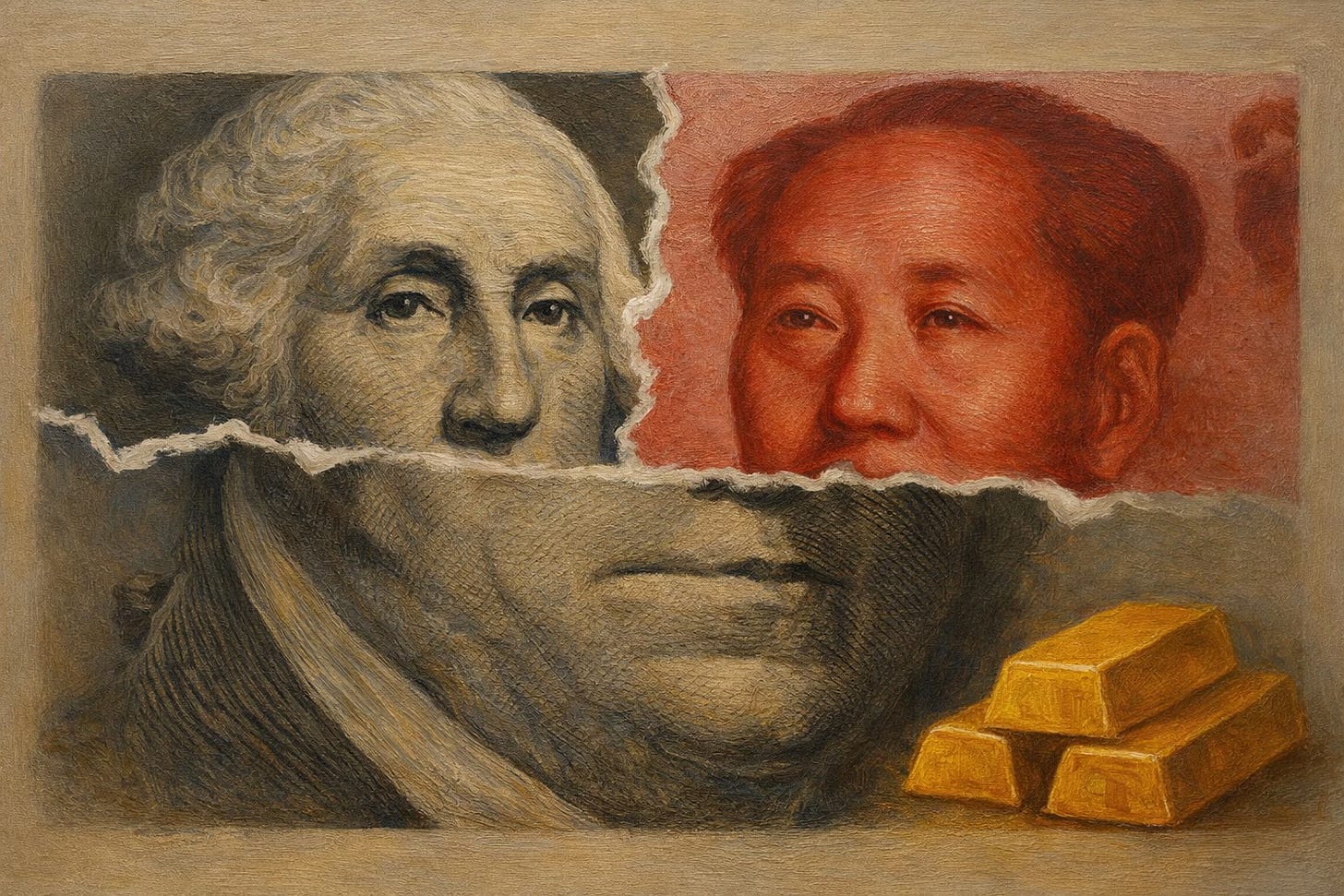

Hedging. Not De-Dollarization

China’s financial moves prepare for shocks but keep the dollar at the center.

China isn’t dismantling the dollar. It’s building insurance against a system that can shut it out overnight.

The 2022 freeze on Russia’s $300B was the wake-up call. Since then, de-dollarization makes headlines while balance sheets show something more mundane: hedging.

Yuan sits at ~3% of global payments. Trade finance climbs to ~6%. Reserves lag at 2.3%. …