Even at 0%, Housing in America Is Broken

Homeownership is now out of reach for most Americans

Zillow admitted something remarkable this week. Even at zero percent mortgage rates, houses in six major American cities would stay mathematically unaffordable for median earners.

Not 3%. Not 2%. Zero.

San Jose: $1.64 million median home price. At zero interest that's still $4,556 monthly over thirty years. Median household income there runs about $150,000. After taxes, maybe $9,000 monthly. So half the net goes to housing... at zero percent.

Los Angeles actually looks worse by price-to-income metrics. 12.2x median income. Miami sits at 8.5x. San Francisco, New York, San Diego bounce between 9x and 11x. National average stands at 4.6x. Four times income used to mark the absolute limit of responsible lending. These cities blew past that years ago.

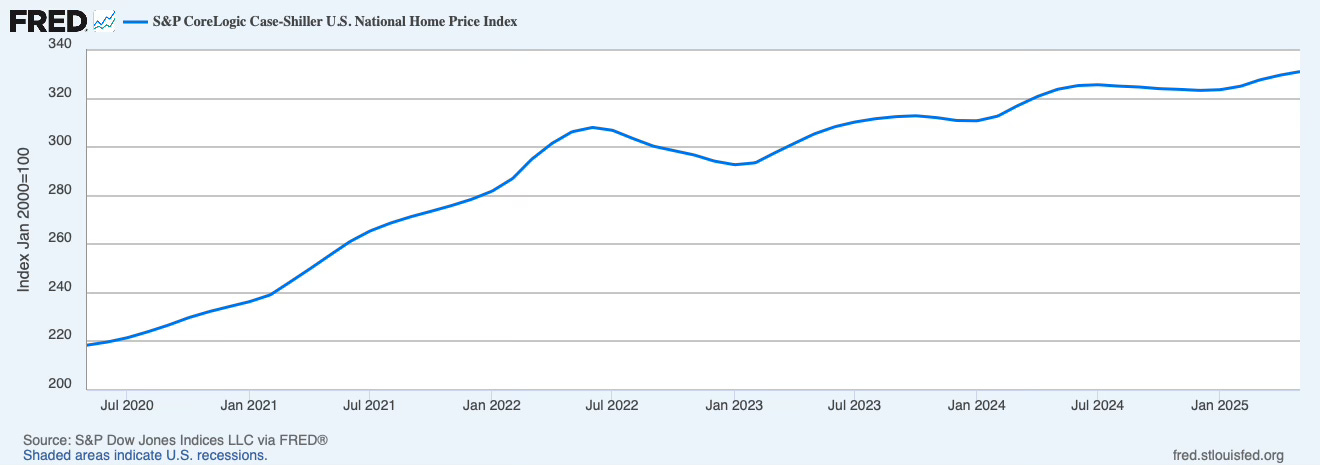

Current homeowners with 3% mortgages from 2020-2021 aren't selling. Trading a 3% rate for today's 7% doubles the payment on a similar property. So inventory stays frozen. Prices stay high despite rate hikes.

See that little dip in 2023. That's the entire "correction" from 8% mortgage rates. Then straight back to new highs.

The Fed basically created two Americas: those who got pandemic rates, and everybody else stuck outside looking in.

Even if rates dropped to zero tomorrow, unlocking all that inventory, that $1.6 million San Jose house stays $1.6 million. The monthly payment might be manageable for some, but the down payment alone would crush most buyers.

What Happens at Zero?

At 0% rates, Blackrock and every other institutional player would borrow unlimited amounts. Borrow millions free, collect 4-5% rental yields. Pure arbitrage. These deals would get snapped up by funds before regular buyers could even tour the property.

Zero percent wouldn't help families. It would finish transforming housing into a pure financial asset, owned by institutions and rented back to workers. Kind of makes you wonder if that was always the plan.

Treasury finally said what everybody knew: home prices and rents broke free from wage growth completely. Median homes need six-figure incomes. Average salary barely hits $60,000.

Tech workers pulling $300,000 can't buy in Silicon Valley. Wall Street types making seven figures struggle in Manhattan.

Miami shows how broken things are. Construction costs up 30% since 2020. Local developer says he's got qualified buyers ready but can't build anything at prices that work. Demand exists. Financing exists. The numbers just don't add up even for new construction.

Tokyo 1989. Real estate worth more than all of California. Everyone assuming salaries would keep doubling. Young people completely priced out. Thirty years of deflation followed. Properties lost 60% nominally. An entire generation never recovered.

Miami might avoid that fate though. The city keeps attracting international buyers and remote workers. Those $50,000 local earners struggle with $628,000 homes, but the market doesn't really care about them anymore.

Current owners love watching their paper wealth grow. Cities need those property taxes. Banks want bigger mortgages. Investment funds keep accumulating. Everybody wins except people who need somewhere to live.

There are solutions floating around. Tax land value differently. Limit institutional buyers in residential markets. Build more units, lots more.

The political will just isn't there yet. First-time buyer credits keep getting proposed instead. Affordable housing mandates that produce dozens of units where thousands are needed. Small steps when the problem needs giant leaps.

"Move somewhere cheaper" people say. Boise, Nashville, Phoenix all went crazy too. The infection spread everywhere. Remote work looked promising until companies demanded everyone back. Now those pandemic movers sit hours from jobs with underwater mortgages.

San Jose at zero percent still needs $4,555 monthly.

Miami needs $1,744.

These aren't mortgages anymore. They're lifetime subscriptions to shelter.

Japan tried this in the 90s. Zero rates for decades. Result: zombie banks, zombie companies, zombie economy. Houses still unaffordable for the young. Deflation for thirty years.

American policymakers probably studied that case. They might navigate it differently.

The lock-in effect creates its own dynamics though. Three million mortgages below 3%. Seven million below 4%. These homeowners have golden handcuffs. Moving means doubling their payments.

So the market stays frozen.