Deindustrialization, China Shock 2.0.

Germany’s factories face the same hollowing-out America once knew.

Germany built China's factory. Now the invoice is brutal.

For two decades, Berlin sold the machines, the chemicals, the premium badges. Profits looked effortless. Beijing studied the playbook and then rewrote the game.

What you're watching is a targeted hit on the German model itself. Call it China Shock 2.0.

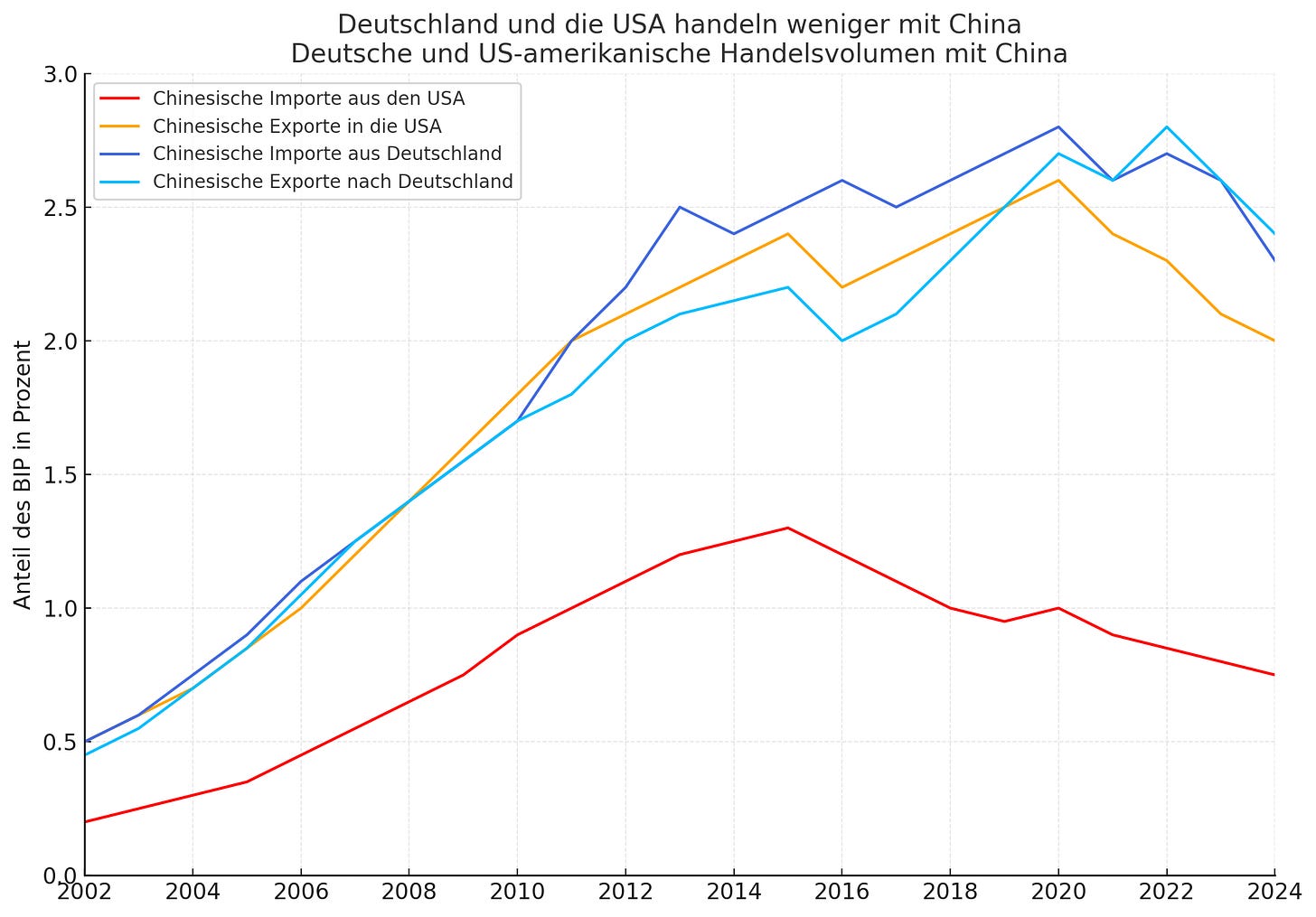

Forget the fairy tales about a cyclical dip. The data already mapped the turn. At the top in 2021-2022, Germany's commerce with China ran above 5 percent of GDP. The United States never got close to that kind of exposure.

When the lines roll over after 2022, that's the moment China starts substituting German inputs at home and flooding third markets with its own output. The era of German exceptionalism ended right there.

Start where it hurts most: cars. German brands in China fell from 24 percent share in 2020 to 15 percent through the first nine months of 2024.