Billions Gone on Outdated EV Platforms

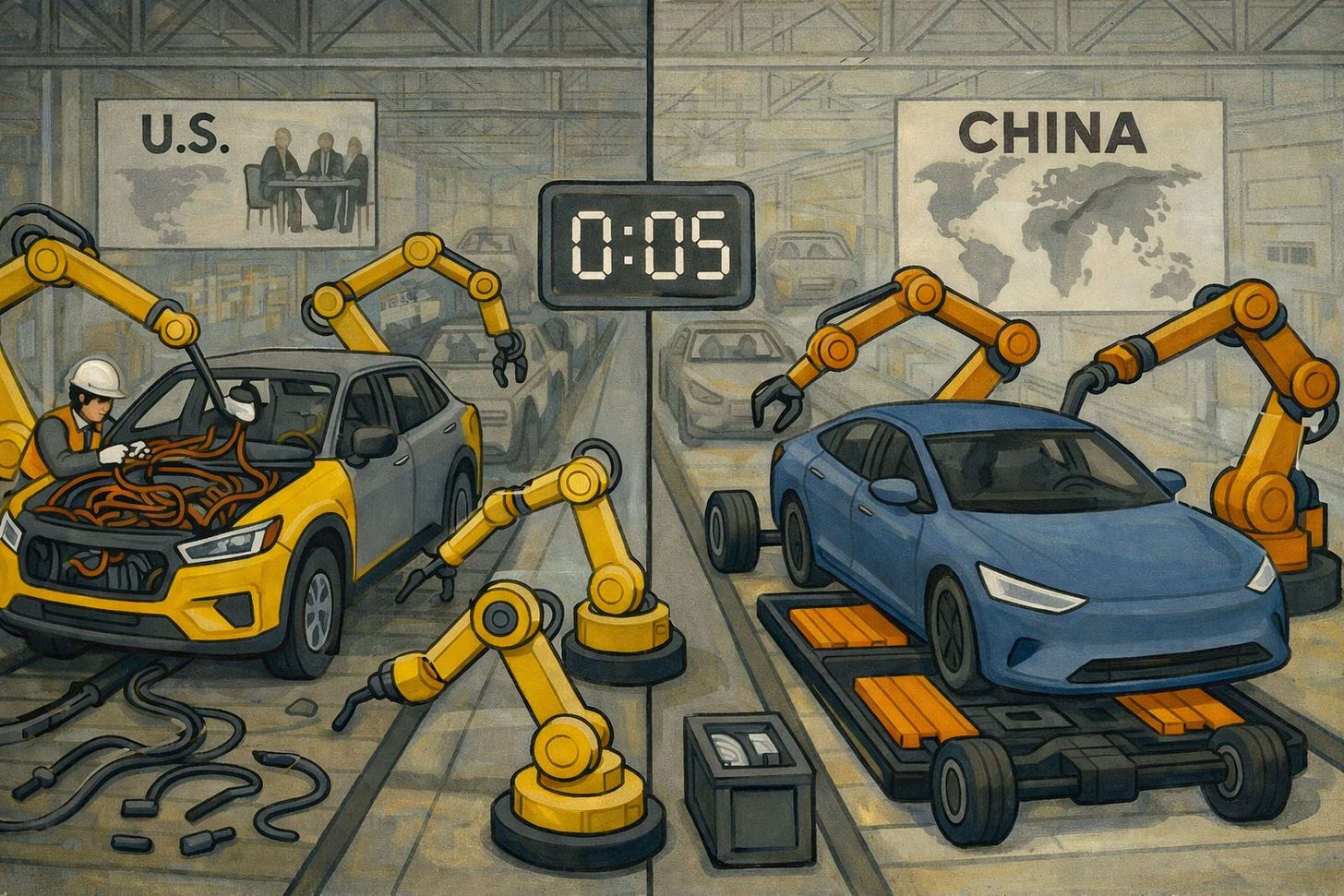

Delays. Outdated designs. A rival still scaling.

The mask slipped when the Ford boss started commuting in a Xiaomi SU7.

SU7: sub-$30k, stupid fast, fat touch screen that bosses your house lights, onboard AI chirping from the dash.

Let those cars cross the Pacific at scale and the U.S. market gets repriced in months, not years. Europe’s already watching Chinese share creep toward Mercedes-level presence.

Lose this one and there isn’t a next cycle.

Dearborn’s reply is to rip out the guts and start over. Louisville gets a clean-sheet EV truck in 2027 with a ~$30,000 sticker.

The process matters. Think assembly tree: three branches, battery and big body chunks meeting mid-air. Fewer parts(about 20% down). Half the hoses. Throughput up ~15%. The architect bench is full of ex-Tesla and ex-Apple people who know where the wiring looms hide the bodies.

Just a grim list of 100+ small cuts in cost and complexity.

Batteries turned drivetrains into the bill of materials, so the winners re-wrote body engineering around the pack and its cooling.

China ran with it.

While U.S. incumbents debated trims and dealer allocations, Shenzhen dialed cycle time and vendors into one organism. Ask a line worker at BYD pulling about $850 a month what competitiveness means when the subsidy stack, engineering depth, and local supply chain come pre-installed.

Ford’s P&L says the quiet part. Billions torched on first-gen EVs built on retrofitted gas bones. Roughly $2 billion gone in six months because wiring harnesses and cooling snakes were designed for yesterday’s architecture. Big EV SUV teased, then quietly killed. Model cadence slipping while GM drops fresh metal.

Meanwhile, Chinese EVs are already climbing hills in Nepal, chewing potholes in Djibouti, plugging into rickety grids in Ethiopia. Low maintenance plus cheap electricity beats long gasoline supply chains with leaky hoses.

Volume breeds learning. Learning murders price.

History check: Executives cried about Japan in the ‘80s, then adapted. Different beast now. Japan didn’t own the critical minerals, the cathode factories, the low-cost pack assembly, and the new software stack. Today’s rival does. The moat isn’t a brand; it’s throughput per dollar of capex and a supply chain that shows up sober on Monday.

Facts on the table: Chinese brands nudging toward Mercedes-level share in Europe. A U.S. factory blueprint that trims parts ~20% and speeds builds ~15%. Losses of ~$2B in six months on legacy EV lines. BYD paying ~$850 per month on the line. A plausible milestone: a Chinese EV built on U.S. soil before January 2029.

And that’s the ballgame unless the stack gets fixed. Cells, inverters, thermal, software, logistics, labor rules, power prices. Fewer meetings, more takt time. Less brochure, more throughput.

Open the gates and learn fast, or keep them shut and pay more for less at home.