Banning Wall Street Landlords 3 Years Too Late

Institutional buyers own 1% of homes and stopped purchasing in 2024. The real supply crisis gets tariffs and mass deportation instead.

The midterm clock is ticking and the housing crisis is devouring family budgets at a rate that makes pandemic inflation look quaint. So naturally, the administration has decided to fight a war that ended three years ago while simultaneously sabotaging its own construction industry.

The centerpiece is a ban on institutional investors buying single-family homes. Wall Street landlords, the President calls them. Perfect television. Also completely divorced from reality.

Institutional buyers owned roughly 1% of the total housing stock at their peak. By 2024, they’d already retreated on their own, driven out by the same interest rate environment crushing everyone else. Major players were actively selling inventory in some markets.

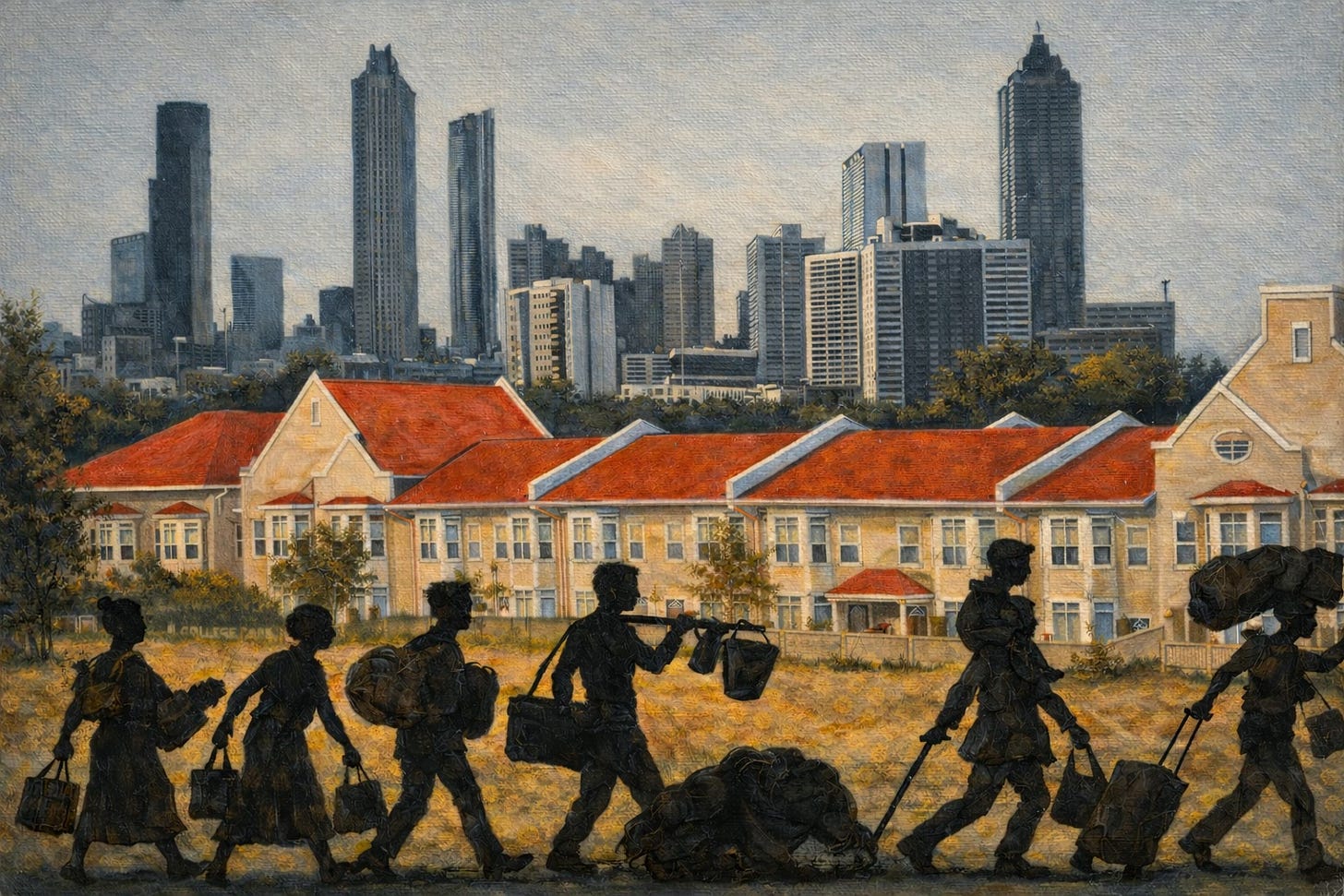

Sure, in specific Sun Belt metros the numbers looked worse. Atlanta, Phoenix, Dallas saw institutional ownership hit 8-10% locally. Certain subdivisions pushed past 20%. These were the markets where corporate buyers competed directly with families, paying cash and waiving inspections.

A ban might have mattered there. In 2021. When the buying spree was actual.

But cost-of-capital constraints solved that problem. The demand shock the President promises is a mirage. What the ban will accomplish is strangling Build-to-Rent development, which involves institutional capital funding entirely new housing communities. BTR adds net supply. Kill the financing and those units disappear.

The policy meant to help families could end up reducing rental housing supply and forcing renters into an even tighter apartment market.

And mortgage portability. Let borrowers take their low rates with them when they move, the theory goes, and inventory floods back. Over half of mortgage holders locked in rates below 4% during the pandemic. With current rates near 7%, they’re handcuffed.

Portability supposedly liberates them.

Except the U.S. mortgage market runs on securitization. Lenders bundle loans into securities and sell them to investors worldwide. The value depends on predictable cash flows, modeled around the assumption that borrowers prepay when they move.

A 3% mortgage in a 7% world is already a liability. If that liability persists for 30 years instead of the expected 7, investors face massive extension risk. They’ll reprice immediately. First-time buyers could see rates spike to 8.5% or beyond.

It’s a wealth transfer dressed up as liberation.

Most movers are trading up. Someone with a $300,000 balance buying a $600,000 home needs gap financing at current market rates. Managing two loan segments tied to a single property complicates everything. Administrative costs eat the savings.

Neither proposal creates a single additional housing unit.

Meanwhile, the administration’s broader agenda is generating supply shocks that dwarf any theoretical benefit. Tariffs on Canadian lumber, steel, and aluminum add thousands to the cost of new construction. For every $1,000 increase in home price, roughly 140,000 households get priced out.

The mass deportation strategy is worse.

Immigrants comprise 30% of the construction workforce. Undocumented workers make up somewhere between 14-23% depending on who’s counting. In wet trades like roofing and drywall, the reliance is even higher.

Removing over a million construction workers from an industry already short half a million would trigger a capacity collapse. Project timelines double or triple. Labor scarcity drives wage inflation. Many affordable housing projects become financially unviable and simply stop.

Tariff-driven material inflation plus deportation-driven labor inflation creates a cost-push spiral. Even if demand softens, prices can’t fall because the replacement cost of housing has skyrocketed.

The actual solutions are sitting in policy papers nobody’s reading. Minneapolis eliminated single-family-only zoning and saw housing stock grow 12% while rents rose just 1%, compared to 14% across the rest of the state. Oregon’s state-level preemption of exclusionary zoning created a pipeline of tens of thousands of units.

These are the boring but important fixes. They require focused policymaking, political patience, and a willingness to override suburban homeowners who prefer scarcity.

They won’t fit on a campaign hat.

So instead, the 2026 housing agenda offers made-for-TV slogans attacking phantoms. The investor ban legislates yesterday’s problem. Mortgage portability breaks the financing machinery. Tariffs tax construction. Deportation purges the labor force.

Thank you for this!

Support and volunteer for Habitat for Hummanity. That undercuts the market and is more affordable.