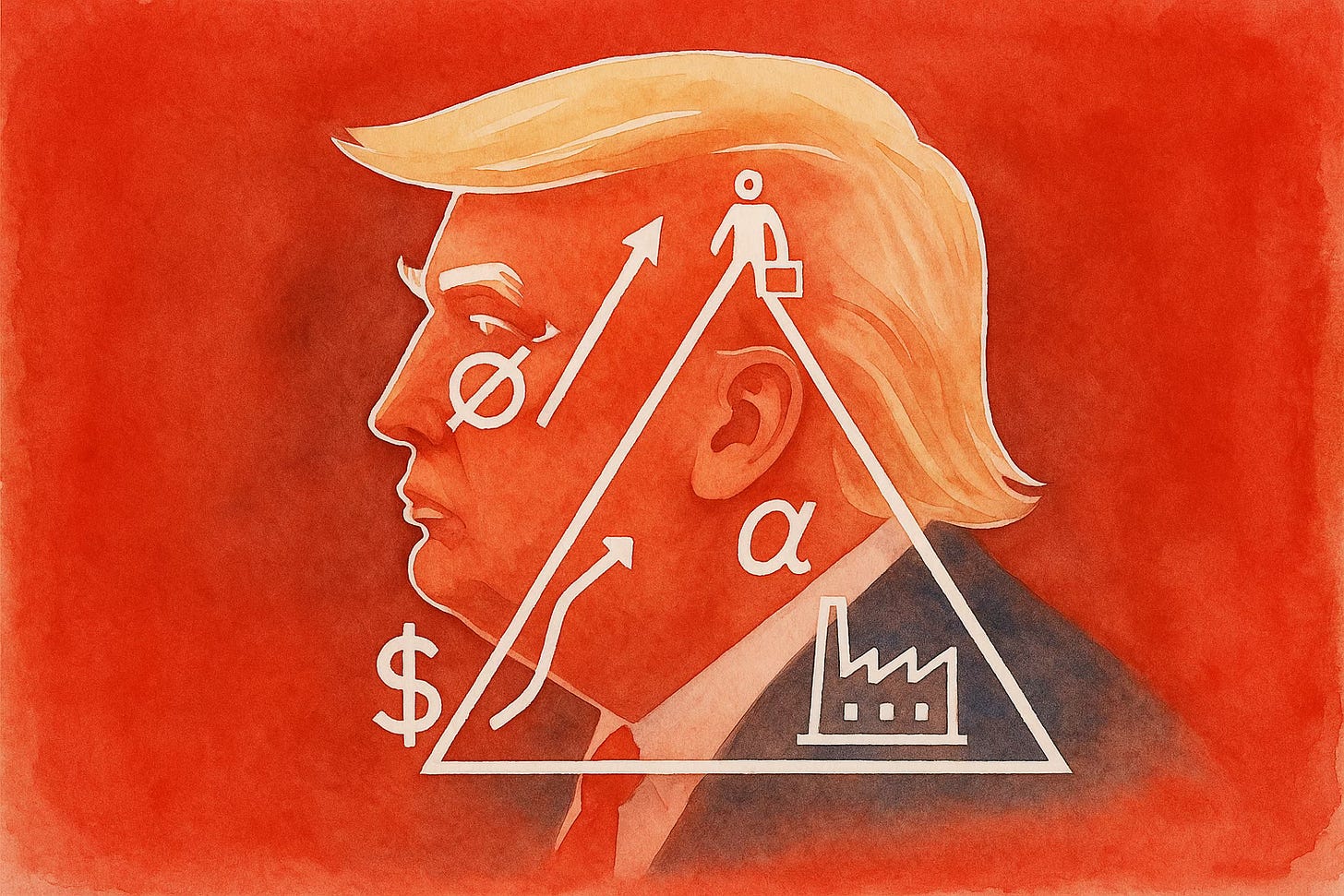

America’s Economic Trilemma

Immigration caps, cheap-price promises, and industrial revival don’t add up.

America keeps selling a free lunch that markets can’t digest.

Imagine telling your shareholders you’ll cut staff by a third, halve prices, and triple output. They’d laugh you out of the room. That’s the national pitch right now: fewer immigrants, cheaper goods, a homegrown manufacturing surge.

You don’t need a PhD. You need a calculator.

Pick any two. Trying for all three buys volatility.

Start with the day-one lesson. Shrink the supply of workers and wages rise. Firms fight over a smaller pool, labor costs climb, final prices follow. Pillar one knocks out pillar two before you even get moving.

Now layer in the manufacturing promise. Factories don’t assemble themselves. You need electricians, welders, equipment operators, foremen, and crews to pour concrete before any line ever turns. You cannot build a factory without a workforce.

Protectionism tightens the bind. Tariffs get sold as a patriotic fee foreigners pay. In practice they act like a sales tax on American buyers. Put a levy on steel and every automaker, appliance maker, and construction firm takes higher costs. They swallow margin or pass it through. There isn’t a third path.

The revenue cheerleading misses the scale. A few billion in duties can’t offset economy-wide pass-throughs that touch every bill of materials. The deeper issue isn’t a one-off hit. Reshoring swaps efficient global supply lines for higher-cost domestic ones. That’s a structural choice, not a weekend sale price. Globalization kept a lid on prices for decades. Unwinding it plants a steady inflation pulse that won’t fade on its own.

All of this sticks the Fed in a bad seat. The mandate is price stability. Immigration caps push wage inflation. Tariffs and reshoring push input inflation. To chase a two percent target, policy stays tighter for longer.

Tighter policy raises the hurdle for the very investments politicians claim to want. New fabs, battery plants, tool-and-die shops, the subcontractor network that makes big capex worth it. Higher borrowing costs slow groundbreakings. Slower growth cools demand for what those plants would sell.