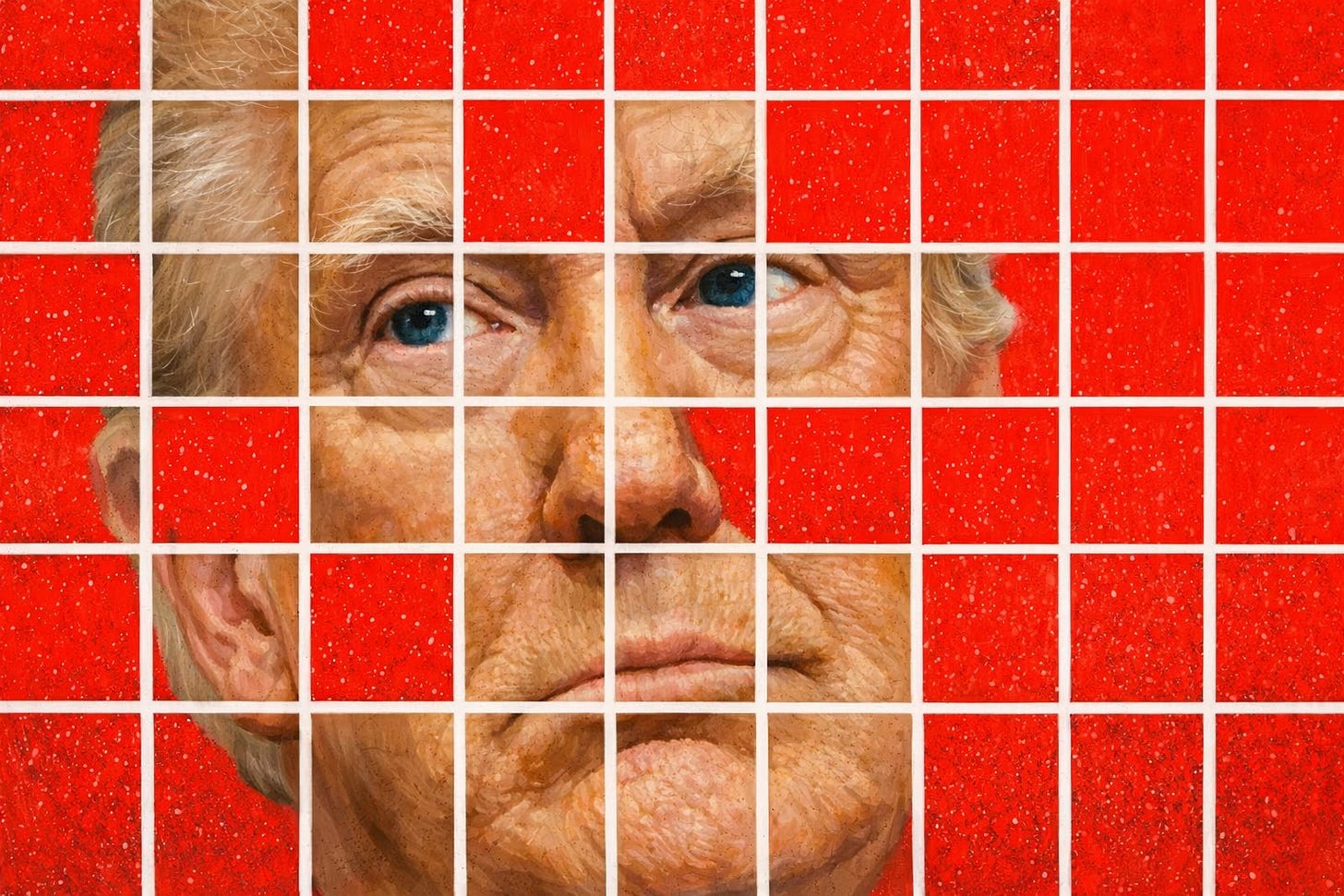

America First? Try Portfolio First

Trump’s tariff war spares his own stocks. Apple and Nvidia.

Donald Trump declared plans for a 100% tariff on semiconductor imports while promising to exempt companies such as Apple Inc. that move production back to the US.

And wouldn’t you know it, the president just happens to own $1M+ worth of stock in Apple and Nvidia, two companies he has given preferential trade treatment.

What are the odds.

This isn’t some abstract policy debate anymore. The president’s latest financial disclosure lays out significant investments in a sector where he has exerted unprecedented influence.

August 6th rolls around, Tim Cook shows up at the White House with a gold-plated plaque and a $100B manufacturing promise… and suddenly Apple gets its Get Out of Tariff Free card.

The same day.

Nvidia’s Jensen Huang gets his audience too. Both companies walk away with exemptions from semiconductor tariffs that would’ve crushed their margins. Both happen to be in Trump’s portfolio.

The looming threat of tariffs on semiconductors will cause the price of hundreds of items to increase — everything from alarm clocks to baby monitors, fitness trackers to smart TVs.

But not iPhones. Not RTX 4090s.

Those get the presidential blessing because their manufacturers promised to build more stuff domestically.

Right.

Every other tech company scrambling to avoid 100% tariffs on chips can’t exactly walk into the Oval Office with a CEO photo-op and a pledge written in gold leaf. The exemption criteria appear remarkably specific: be large enough to matter, commit to U.S. manufacturing, and ideally be held in the president’s trust fund.

Business leaders have pledged at least $1.6T in US spending since Trump was elected to a second term. If history is any guide, not all of it will materialize.

But the exemptions are immediate. The investments? Those can be renegotiated later, when the cameras are off.

Somebody pays the tariffs — ultimately consumers through higher prices.

– Fed Chair Jerome Powell