$1,400 for the Lucky Few

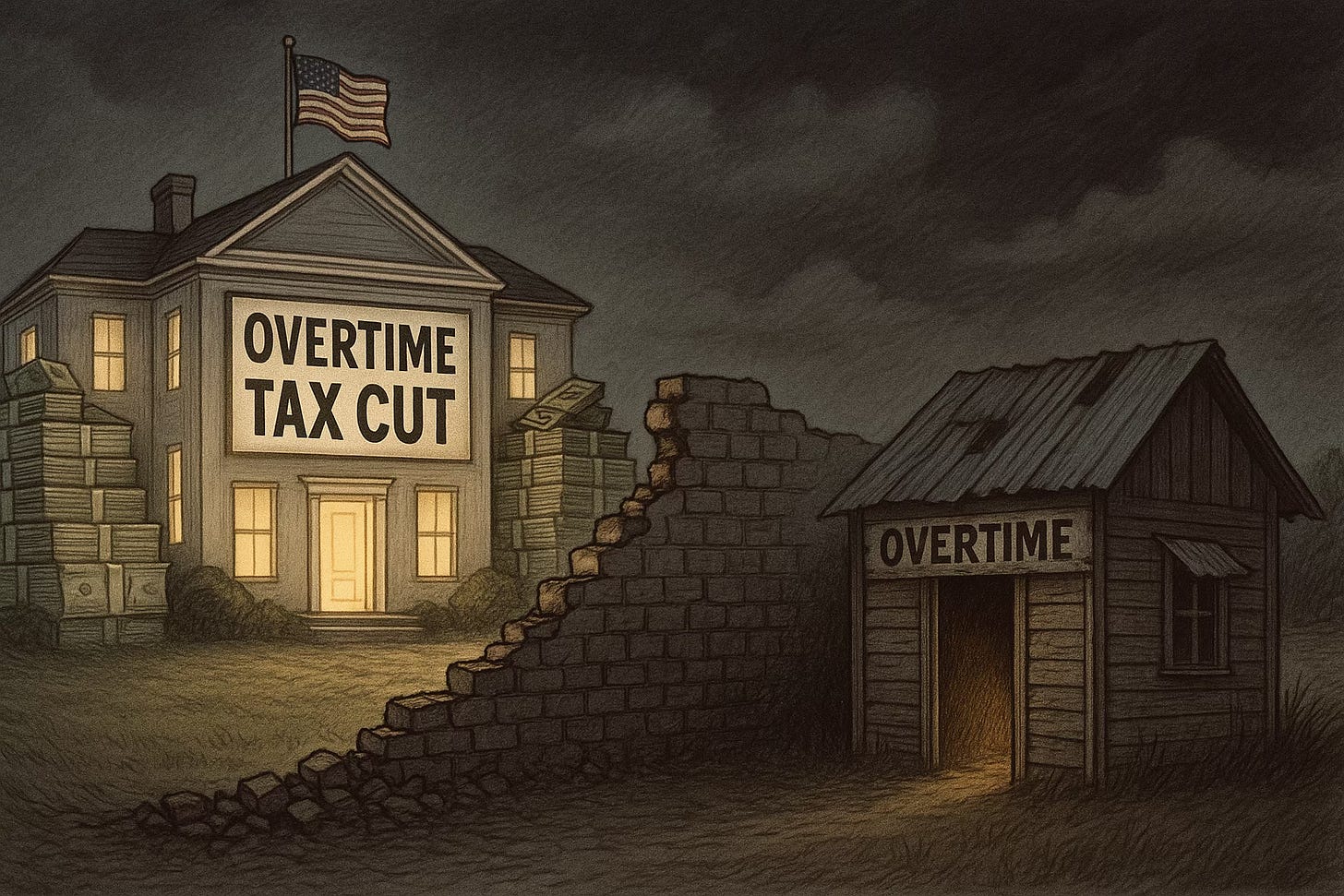

Trump’s overtime tax break leaves out most American workers.

Trump’s Big Beautiful Bill promises no federal tax on overtime pay. The slogan sounds clean. But only the half in time-and-a-half is exempt. Capped at $12,500 a year ($25k for couples). Payroll taxes still apply on every dollar.

Only about 9% of households see a real benefit. The average savings: $1,400 annually.

Spread across everyone, it’s closer to $130.

Salaried workers get nothing. Millions grinding nights and weekends with no hourly rate don’t qualify. Union mechanics under the Railway Labor Act? Excluded. Nurses working double shifts? Depends on the contract. Two people with the same income can face different tax bills just because one’s hourly and the other isn’t.

Employers get their own angle. Easier to stack hours on fewer workers instead of hiring more. Overtime becomes cheaper after-tax.

Run the numbers: a $15/hour worker saves about 94 cents per overtime hour at a 12.5% federal rate. Thirty-two overtime hours in a pay period = $72 extra every two weeks. Nice, but it doesn’t cover food inflation or rent hikes. Families under $35k? Almost none see a dime, since they already pay little or no federal tax.

The law sunsets in 2028. Plan around the modest bump and it could vanish overnight. A slightly bigger refund in April for a few years. Then gone.

So yes, overtime pay is technically tax-free. But only the sliver that qualifies. Only until 2028. Only if you’re hourly, under the income cap, and in the right type of job.

Tell me about this tell me about how you created it because I love the way your mind works.

Most companies DO NOT even OFFER full or overtime work in order to AVOID offering health care insurance! Sadly, this is not a new avoidance.

Calling BS on the bogus crumb offer !

#ReleaseTheFiles